What Cashback Is and How to Use It

5-Minute Crafts has reviewed experts’ recommendations and is prepared to tell you what to pay attention to when choosing credit cards with cashback and how to use them.

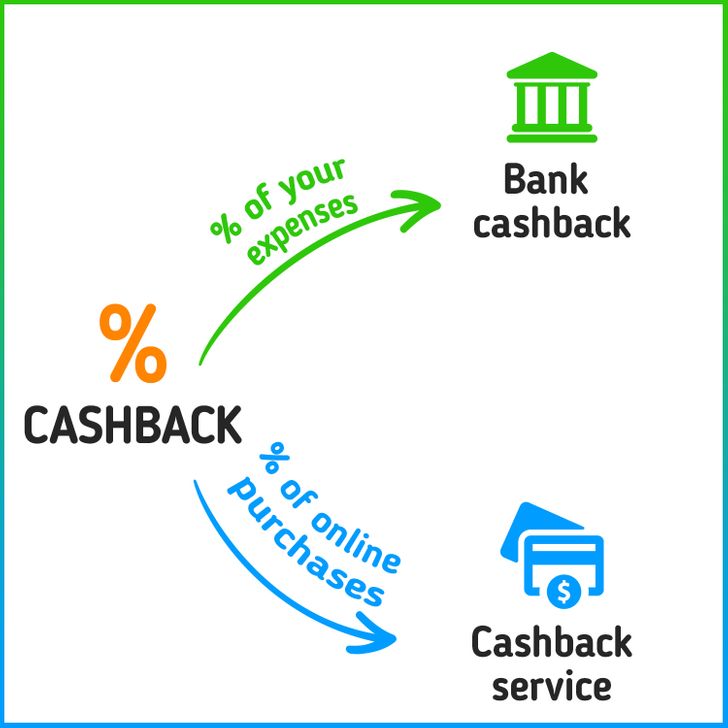

The types of cashback

-

Cashback services collaborate with online stores and make a catalog with links. When you click on a link, the service tracks your purchase and returns you the percentage they promised. Usually, cashback is given in the form of money to your personal account in the service. When you save a certain amount, you can withdraw the money to a bank account or your mobile operator account. For example, if you click on a 10% cashback offer and buy something for $1,000, you can expect to get $100 back.

-

Bank cashback can be used when you get a bank card and use it to pay for anything. Different banks have different offers and can include the following:

-

Miles you can use to buy a plane ticket

-

Bonuses you can spend on a purchase

-

Coupons that give you discounts at certain stores

-

Money that’s sent to your bank account regularly

Usually, bank cashback is a percentage of the expenses on your card. For example, you may buy food at a supermarket and pay with your card. Say you spend $100 and the cashback deal is 1%. This means you will get $1 back at the end of the billing period.

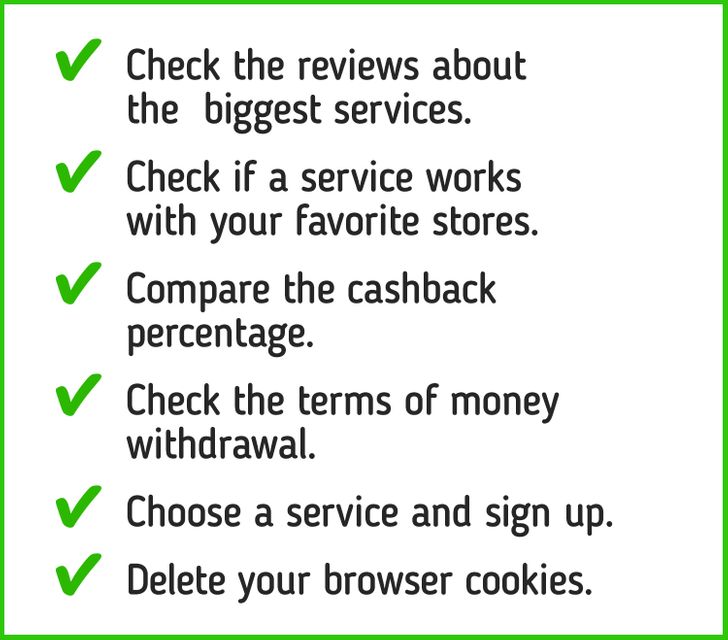

How to choose a cashback service

-

Find the websites of the biggest cashback services and read the reviews. Check if there’s any kind of trouble with calculating and transferring cashback, its withdrawal, and the website function in general. Make a list of services that need to be checked.

-

On every website, look at the catalog of internet stores that you will get cashback for. Ideally, they should be stores you regularly buy things from.

-

Compare the cashback percentage on the chosen websites.

-

Read the terms of money withdrawal: what amount you need to have to get the money, how to withdraw, and how long it takes.

-

Choose 1-2 services you like, sign up, and add them to your favorites. When you need to buy something online, find the store you’re shopping at in the catalog of the chosen cashback service, go through the link, and make the purchase.

-

Before clicking on the link, just in case, delete the cookies in your web browser settings. This way, you will definitely receive your cashback.

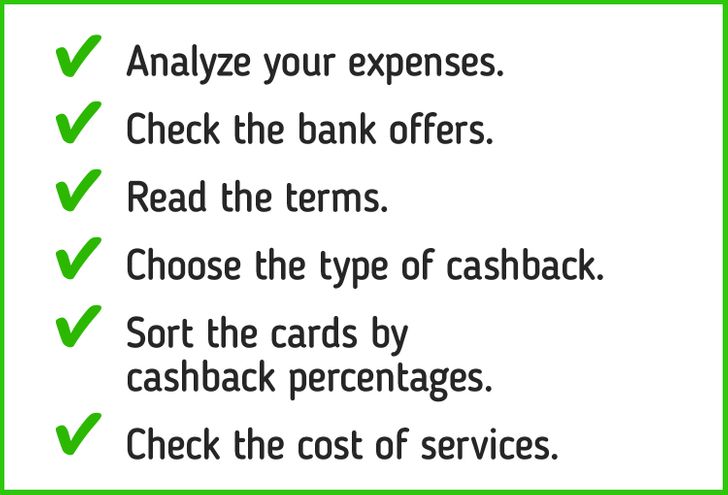

How to choose a bank card with cashback

-

Analyze your expenses for 1-2 months and pay attention to how much you spend on average, how often you pay with your card, and what you spend the biggest amounts of money on.

-

Check cashback cards from different banks. There are a lot of different bank forums and other websites with lists of the best offers.

-

Read the terms of what qualifies for cashback. Since cashback can be used to attract new clients, banks often set a minimum amount you have to spend with your card a month. If you don’t spend this amount, you won’t get the cashback.

-

Pay attention to the type of cashback availabe. Miles are great if you travel a lot while bonuses and coupons are good if you shop a lot online. And money cashback is probably the best and most versatile.

-

Sort the bank offers by cashback percentage and check if they have some categories with higher percentages. For example, if you often pay at gas stations, you might look for a cashback offer for drivers.

-

Don’t forget to check the cost of services for the cashback cards. They might be more expensive than the actual cashback you’ll get.

Useful recommendations

-

Combine cashback services and bank cards. Click on the links of the services and use the cashback cards to pay. You’ll get more this way.

-

Pay for most of your expenses with a bank card. This way, you’ll get returned some of the money you spend.

-

If you spend big amounts of money every month, it may be a smart idea to have several cashback bank cards if they have good offers for different categories. For example, one card may have good cashback options for gas stations and cafés while another card could offer cashback at supermarkets you frequent.