How to Save Money Fast: 9 Tips

The conditions of the economy are always unpredictable and are not under your control. But you do have control over your spending habits. So let 5-Minute Crafts be your guide to help you save money in unconventional and effective ways. No typical finance tips, we promise.

1. Never go grocery shopping on an empty stomach.

Don’t go shopping after you’ve had a busy day or week either. This is because it may tempt you to buy unhealthy food and make unwise financial decisions. Also, when you go grocery shopping, always make a list of things you want before you head out and stick to it.

Another option is to shop for food online. Instead of impulse buying at the stores, you can make the most of deals and offers provided by online shopping websites and save a lot of money.

2. Save big, and not just pennies.

Sometimes, you try to save some cents here and there by buying things that are cheap. However, efficient money saving is only possible when you save a big amount of money. You can begin this by having a harder look at your cost of living.

For instance, it is more cost-efficient to own a house instead of living in a rented one. It’s also wise to browse for low mortgage rates when buying a house. Another example is you can travel to work by train so that you don’t have to buy a car.

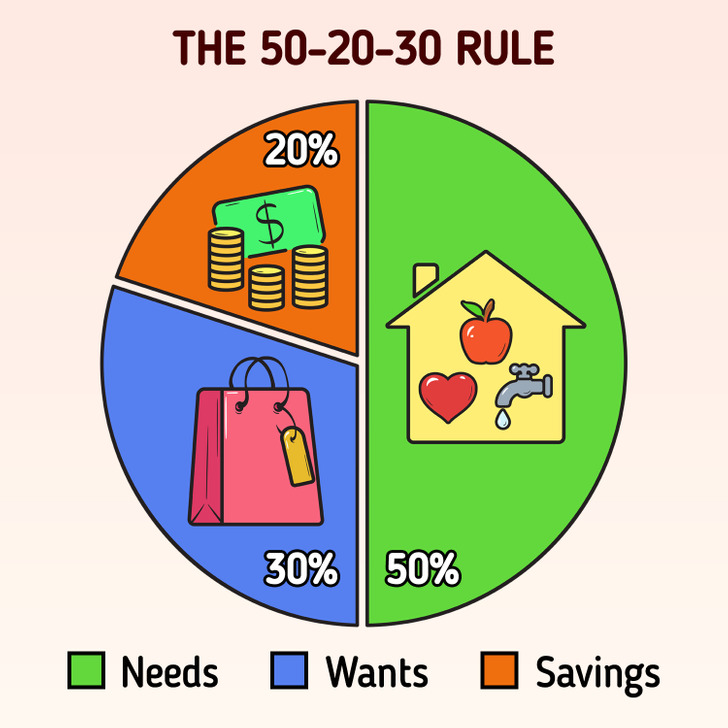

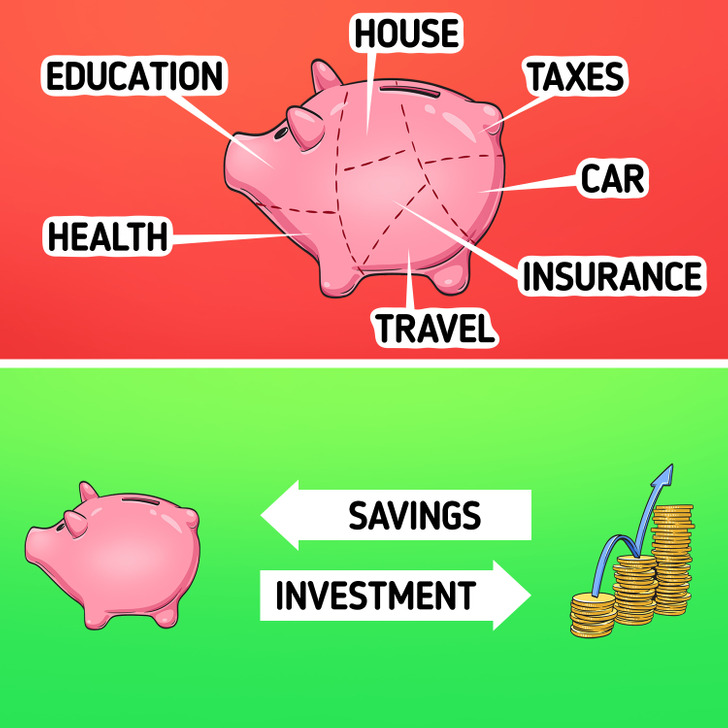

You can also follow the “50/20/30” rule where you dedicate 50% of your after-tax income to your utilities, 30% to your wants, and the rest of the 20% goes to savings and investments.

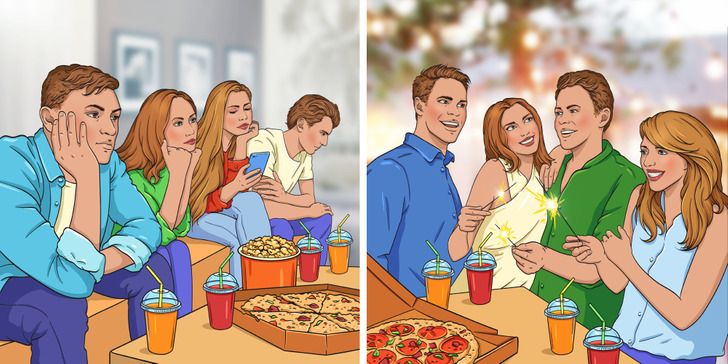

3. Rather than having lots of mediocre experiences, go for fewer but extraordinary ones.

This tip states that you can save up for a few weeks and then book a hotel in a big city and have a good time. Since you have money saved, you don’t have to worry about your expenses and don’t have to be frugal with your experiences. Having fewer quality experiences will save you from a lot of mediocre experiences that may require you to spend a lot of money.

4. Cancel your subscriptions.

Take a look at all of your subscriptions and cancel the ones you don’t need. Or you can go extreme by canceling every subscription for a month. Then notice which subscription you don’t use within a month. And if you miss using it, take it back.

If a few streaming services are a necessity, then you can limit yourself to 1 or 2 subscriptions. Notice what you use and how many hours you use it for. Then maybe you’ll realize that you don’t need multiple subscriptions.

5. Drive slower.

When you accelerate hard for absolutely no reason, it increases fuel consumption and decreases fuel economy. Driving slower means using less gas, therefore, saving more money.

Also, when driving on the highway, vehicles tend to use a lot of fuel when accelerating. So using cruise control, in this case, helps you save fuel. Paying heed to speed limits, speeding up and braking gently, and looking at the road ahead all help you increase the fuel economy and keep you and other drivers safe on the road too.

6. Don’t spend more money than you have.

Some people prefer buying things with their credit cards. But eventually, they end up with tons of debt for a bunch of stuff they didn’t even need in the first place. To fix this, you may want to learn to be content with what you have and not what you want. And in order not to use credit cards for everything, if you cannot control your spending, just stop using them.

7. Having a good coupon doesn’t mean you have to use it.

A good way to gauge this tip is by asking yourself, “If the item were at full price, would I still buy it?” The point is to not focus on how good the deal is, but on how much money you will save by not purchasing it in the first place.

8. Pay yourself first.

Most people say that they need to spend X amount on rent, Y on groceries, etc., and save the rest. But instead, you may want to focus on saving and investing first, then spend on other items. Begin by saying, “I should save X so that I can spend Y on rent, Z on groceries,” and so on. The gist is to automate everything so that your savings and investments are sorted beforehand.

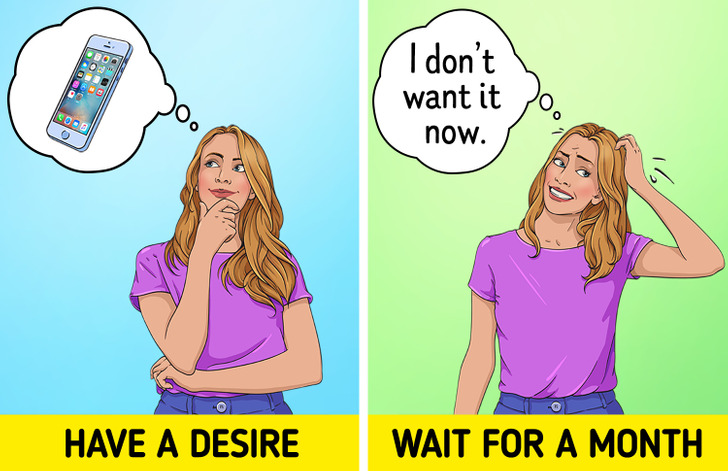

9. Exercise patience when wanting to buy a high-priced item.

This tip states that when you have the desire to buy an expensive item, wait for a month and see if your mind changes. If you still want it after a month, then you can definitely buy it. If you don’t, you’ll definitely save some money.