How to Use a Credit Card Correctly So You Don’t Get Into Debt

A credit card gives you access to a credit line approved by a bank. Every time you use it to pay for your purchases, you take a loan from the bank to cover your expenses and you have to return the money within a certain period of time.

5-Minute Crafts is going to tell you how credit cards work, how to use them wisely, and what to pay attention to when getting them.

How credit cards work

When you get a credit card, the bank you get it from sets the credit limit — the maximum amount you can borrow. It depends on the following factors:

- the level of your income

- whether or not you have other loans

- the credit limit you have on other cards if you have them

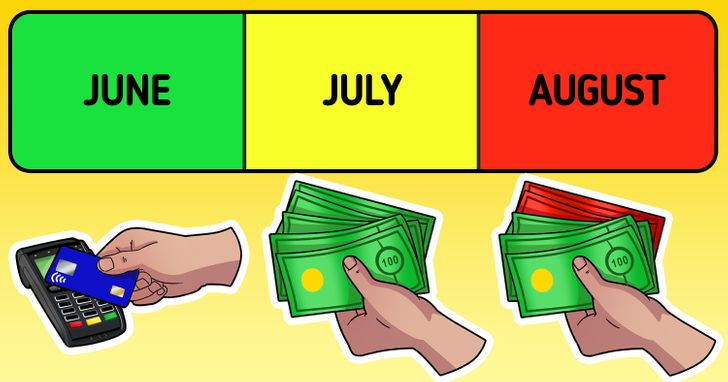

Also, the bank sets the grace period — the amount of time you have to return the money without paying the interest. Usually, it’s around 30 days.

When you make a purchase, you use the credit card to pay for it, and at the end of the period, the bank sends you the bill. In the bill, you will find a list of all the transactions and the amount of your debt. You can return the full amount at once or pay the minimum payment and pay the rest later. In the first scenario, you can pay within the grace period and avoid paying the interest. And in the second one, you will have to repay the amount used with the interest.

What to look out for when getting a credit card

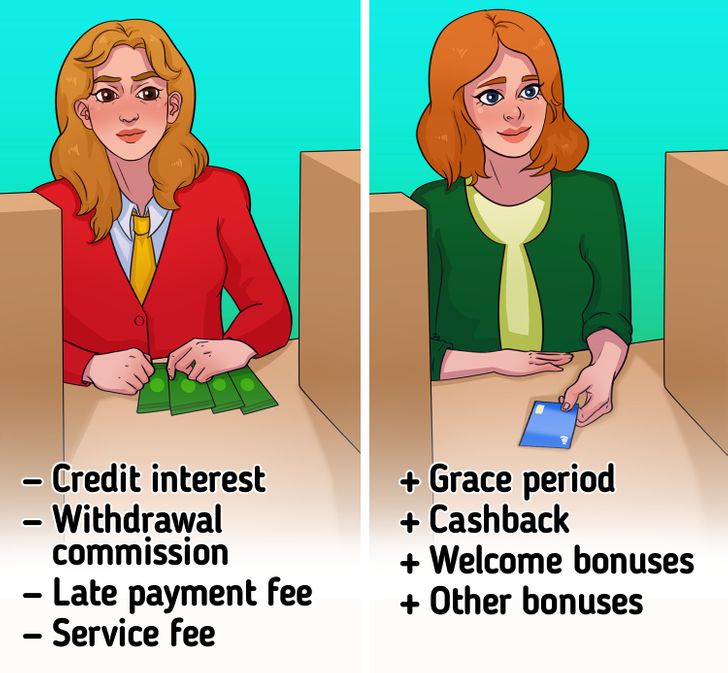

- Loan interest: This is the interest on your loan amount. You have to pay it if the debt is not paid by the end of the grace period. The lower the interest rate, the less you have to pay for using the money.

- Grace period: This is the amount of time you can return the debt without interest. It is usually around 30 days.

- Service (or annual) fee: It’s the money you have to pay for the service. It’s usually charged yearly.

- Other commissions: The bank might charge commissions for cash withdrawals, money transfers, or transactions abroad.

- Late payment fee: Banks may add on overdue fines when you are late with paying your minimum payment. Their rate can also go up the longer it takes you to pay.

- Cashback: In order to make their offer better, banks often give you rewards for using their card. Usually, it’s money, miles, or some other type of cashback. You can spend the miles on plane tickets or hotels. The reward is a percentage from each purchase. The higher the percentage, the more bonuses you get. Cashback may even cover the annual fee and other commissions.

- Welcome bonus: Some banks give you welcome miles and points you can spend on certain things.

- Other bonuses. Depending on the type of credit card or payment system, the bank might offer discounts at certain stores, access to exclusive entertainment, medical insurance on trips, access to special waiting rooms in airports, or other privileges.

Try to choose a credit card with the best conditions. Now we are going to tell you how to use credit cards correctly in order to get the most out of them.

1. Use the card wisely.

Don’t use your credit card for spontaneous shopping. This approach might put you in a situation where you are in debt. It’s better to leave the credit card for emergencies: like paying your mobile phone bill if it’s just 2 days until payday or getting your fridge fixed.

You can use the credit card for big buys carefully if you are confident you can pay the money back. Then, you will be able to pay less interest compared to a regular load or even avoid it completely if there’s a long grace period.

2. Pay on time

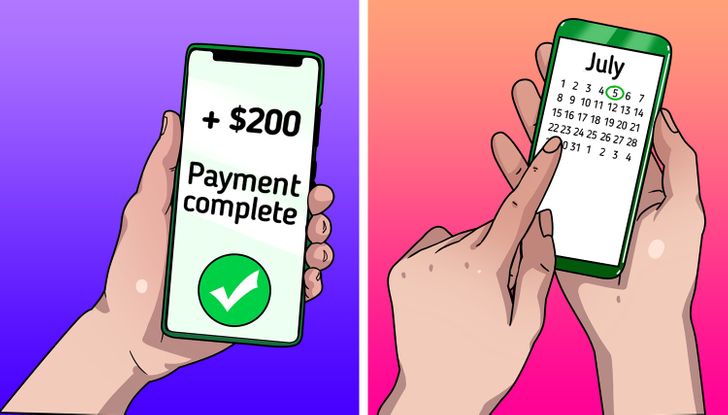

Never pay the money after the grace period and always pay back at least the minimum amount. This way, you will avoid fines and the chance you’ll ruin your credit history.

But if you can, try to pay back the debt in full within the grace period. You will basically use the money for free.

If you are scared you might forget about the payment, put it into the calendar or set a reminder on your phone. Another option is to set up the automatic payments using your bank application.

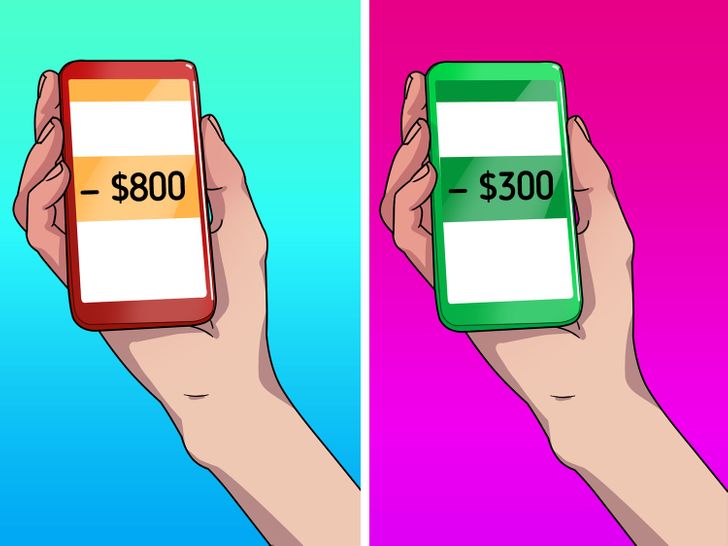

3. Don’t use up the entire credit limit

Try keeping your credit card expenses within the 10-30% range of the limit. For example, if the limit is $1,000, don’t spend more than $300 a month. It will keep the amount of loan payments manageable and form a habit of not spending more than you can return.

If you are worried that you might spend too much, contact the bank and ask them to lower the credit limit to an acceptable level. Another strategy is using the card until you use up the limit you set for yourself (for example, $300 a month) and then put the card away. Use it only when you pay back the debt. It will allow you to stay within the constraints of your budget, and pay the money back on time.

4. Don’t use credit cards as your financial cushion

A basic financial rule is to have a financial cushion that is enough for 3-6 months without income. The biggest risk it saves you from is losing your job. So, while you are looking for a new situation, the money you had saved will allow you to stay afloat and cover monthly expenses.

Of course, saving this amount is not easy. It seems that there’s a simple solution — get a credit card “just in case.” But this approach may only bring on more trouble in the future.

When you lose your steady income, you will start spending credit money. In a few months, it will turn into serious debt and you won’t know if you have a new source of income soon enough. So, you might end up without a job and with debt. To avoid this situation, you need to make a financial cushion using your own money.

5. Don’t withdraw cash

Try not to use a credit card to withdraw cash. Very often, banks get additional commissions for that — up to 4% of the amount. It’s better to use credit cards for online shopping and non-cash payments. And use your debit card to withdraw cash if you need it.

6. Use all the advantages

If the credit card has cashback, you can use it to increase your income. Use the card to pay for your everyday expenses and pay the bank back in full at the end of the money. It is important to do it within the grace period in order not to pay more for interest and commissions.

If you have enough money for a big purchase, you can also use a credit card. Use the card to pay for it and then pay the money back from your regular account and get the bonuses.