How to Use the Envelope Budgeting Method

The envelope budgeting method is a popular system when you divide all of your income into different envelopes, and each of them is used to pay for certain things. It helps you to control your expenses, prevent impulsive purchasing, and save money by putting aside small amounts.

5-Minute Crafts explains how to use different variants of the envelope method to save money fast and achieve your financial goals.

How to use the ordinary envelope system

- Count the amount of money you earn every month and prepare several envelopes.

- Write down the name of the expense on each envelope. For example, “bills,” “transport,” “food,” “entertainment,” “savings.” For each category, you should have a specific envelope.

- In each envelope, you should have the amount of money you are planning to spend on a certain category. Set the right priorities: first, fill out the envelopes that are about the payments you have to make. Then, count the amount of money for food and important purchases. After that, spread out the rest and leave some money for unforeseen expenses and pocket money, and put aside some money to save.

- Then, use the money from the envelopes to pay for everything and don’t forget about these 2 rules.

Rule № 1. If you run out of money in one of the envelopes, you can’t use the money from the other one. Cut down on something, limit your needs, or find a way to earn the necessary amount fast (for example, sell some of your old clothes or things).

Rule № 2. If you paid all your bills and you still have some money in the envelope, you can spend it on something you want or add it to your savings.

You can stick pieces of paper to the envelopes with certain amounts you are planning to spend. It is especially convenient when you need to pay for several things with the money from one envelope. You can also buy a wallet with a pocket for envelopes.

Each time you pay for something, don’t forget to put the change back into your envelope. Very often, we spend considerable amounts of money by just using the change.

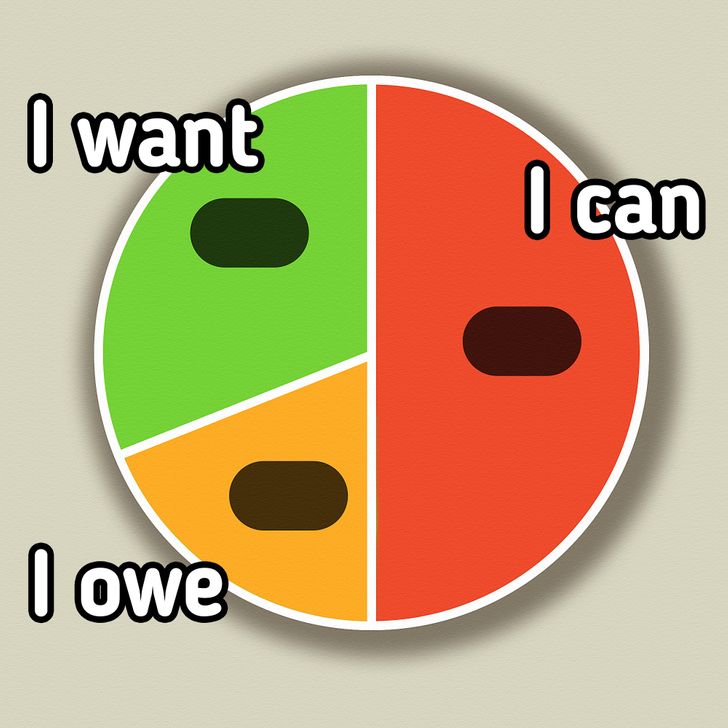

The 50/30/20 rule and the envelope method

If you receive your income in parts and on different days of the month or you just don’t want to do all the calculations, try to combine the envelope method and the following rule.

- Put 50 % of your income into the envelope № 1 in order to spend this money only on the most necessary expenses. They are bills, rent, food, transport, and mortgage.

- Put 20 % of your income into the envelope № 2 using it as a place for saving money.

- Put 30 % of your income into the envelope № 3 and spend the money on entertainment, for example going to the movies or a cafe, or buying new clothes or booking a trip.

If your income doesn’t allow you to distribute the money this way, then fill the first envelope and then put what you have left into the other 2. Don’t stop using the envelope № 2: put aside some money when you can, even if it’s just a little but do it regularly.

If you have some unused money at the end of the month, put it into the envelopes for the next 30 days. For example, if you save on entertainment during one month, you can spend more on this category in the next month.

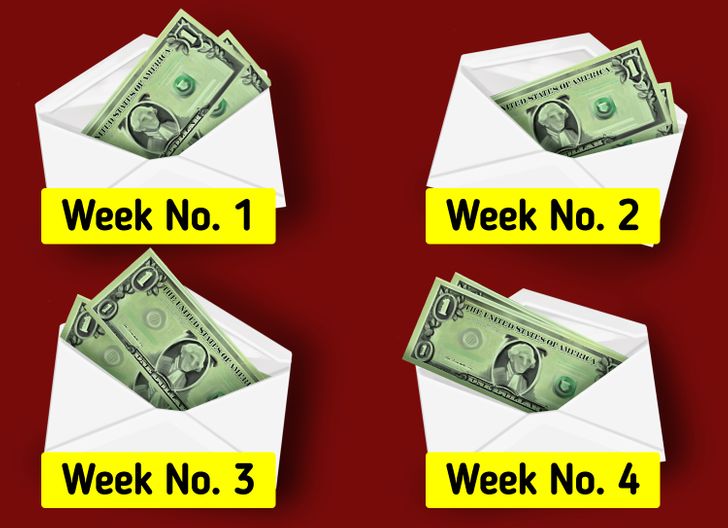

The 4-envelope method

Some people find it easier to use the envelope method by planning their expenses by weeks, not months.

Option № 1.

- Determine your monthly income. Make 4 envelopes for each week of the month.

- Put the amount of money you are planning to spend every week into each envelope. On the envelope, write down what you are going to buy and how much you’re going to spend. Seal 3 envelopes and only use the money you have in the first envelope until the week is over.

- 7 days later, open next week’s envelope. If you still have some money in the first envelope, add it to the next week.

- If you still have some money left after the month ends, put it aside as savings.

Option № 2.

- Count how much you earn over a month. Put 10% aside for savings.

- Count the money you need for constant and regular expenses.

- The money you have left is distributed into 4 envelopes for each week. At the beginning of each week, you open the envelope, take out the money, and put it into your wallet. You buy food, beauty products, you pay for breakfast, and your hairdresser.

- At the end of each day, you count all the money you have so you know what you can do this week. You can take extra money from other envelopes.

The 6-jar method

The 6-jar method is a variation of the envelope method made up by businessman Harv Eker and described by him in the book Secrets of the Millionaire Mind. The idea is to distribute all your income into 6 imaginary jars.

- Jar № 1 (55% of your income). This is the money you can use on mandatory payments (rent, food, transport, mortgage).

- Jar № 2 (10% of your income). This is the money you spend on yourself (going to the movies, going to restaurants, or buying new clothes).

- Jar № 3 (10% of your income). This is the money you spend only on investments and earning passive income in order to be financially free.

- Jar № 4 (10% of your income). This is the money you invest in yourself because self-education helps create additional passive income. You might pay for classes or buy books.

- Jar № 5 (10% of your income). This is the money you put aside and use as a financial cushion or the money you use to make big purchases, like cars or trips.

- Jar № 6 (5% of your income). This is the money you spend on presents for loved ones or charity.

So, fill 6 envelopes this way. The percentages are adjustable, you can change them according to what your need or want. The most important thing is to follow the general plan and not give up on any of the categories. It’s not important how much you put aside, but it’s all about the habit of distributing the money and saving.

What’s good about the envelope method

- When you are paying with a credit card, you might find yourself in situations where you are spending more money than you have. And might even have to pay back more than you spent. When paying cash, you can’t spend more money than you have.

- The people who pay cash are usually more attached to the money, so they end up spending less than those that pay with a credit card.

- For some reason, it might be impossible to check how much money you have before you pay. When paying cash, you always know exactly how much money you have so you can prevent impulsive purchasing.

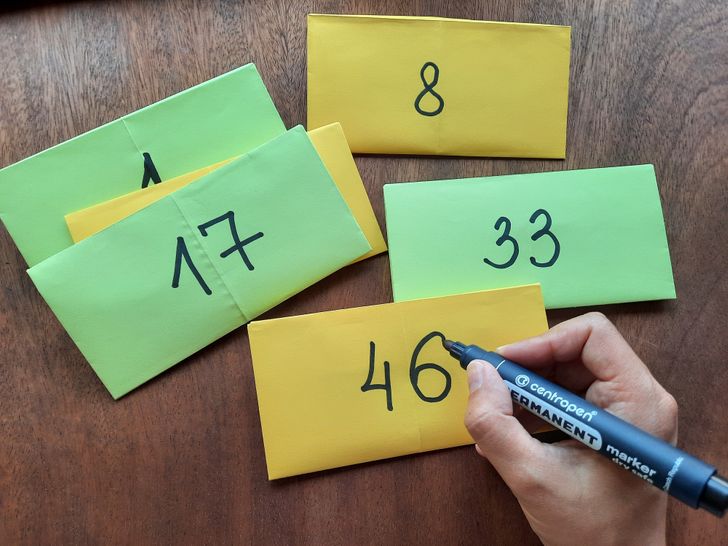

Bonus: How to save more than $1,000 in 6 months using envelopes or a shoebox

Option № 1.

- Take 50 envelopes and number them.

- Mix them and put them into a basket, a drawer, or any other place.

- Once a week, take any 2 empty envelopes and fill them with the amount that’s written on them. For example, if the envelope says 16, you should put $16 into it.

- 6 months later, if you open all the filled envelopes you’ll find $1,275.

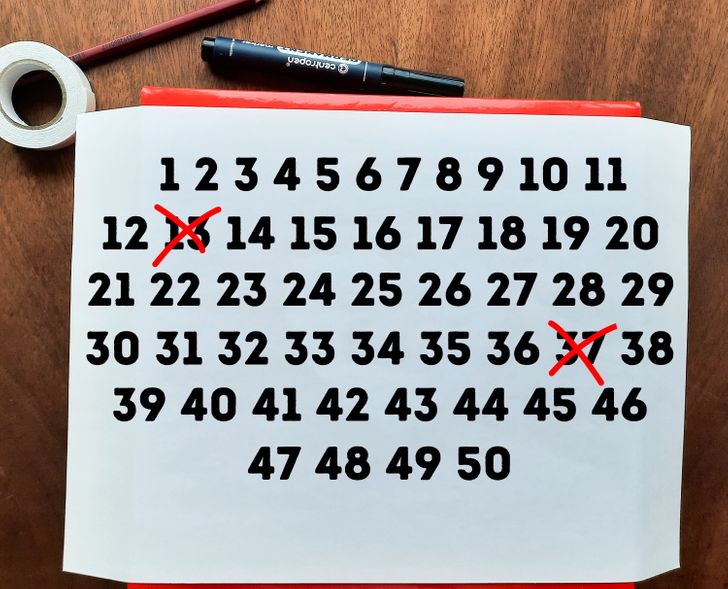

Option № 2.

Here, you use an empty shoebox instead of envelopes.

- Glue paper to the box. Write down the numbers from 1 to 50 as the photo above shows. At the top of the box, make a hole to easily fit the bills in.

- Every week, choose any 2 numbers on the box and cross them out. After that, take the amount of money you crossed out, and put it into the box. For example, if it’s 22 and 4, you should put $26 into the box.

- Continue on until you cross out all the numbers. After that, open the box and take out the $1,275 you saved.