How to Distribute Your Family Budget And Say Goodbye to Debt: 10 Ways

Proper budget distribution helps you to get rid of unnecessary expenses, analyze the importance of certain spending before it creates a problem, and gain control over your finances. It also makes it easier to achieve goals and reduce stress if the latter is associated with monetary obligations. All these are extremely important when it comes to a family budget that requires a certain conscience from each family member.

5-Minute Crafts wants to show you several useful ideas and tips that will tell you how to distribute the family budget evenly, save money for your goals, and say goodbye to debt.

Write down your income and check to see which expenses can be optimized.

It’s important to understand your financial situation and the goals that are a priority for your family. Perhaps you want to get rid of debt fast or reduce expenses to save a certain amount faster.

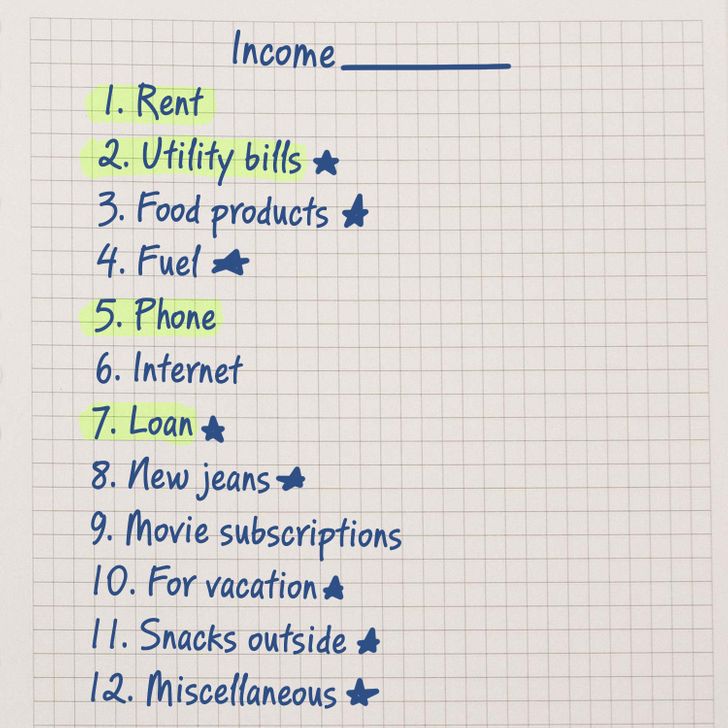

What to do: First of all, create a list that will reflect all of your income and expenses over one month. Take a piece of paper and, using the picture above as a template, write down the following:

- The level of your monthly income. Here, you need to take into account all the possible incomes for your family: salary, income from renting out a property, social benefits, debt that was returned to you, or money received for selling old things.

- Categories of monthly spending according to their importance. At the top of the list, indicate what you need and have to pay first. For example, rent, utility bills, food and household chemicals, communication services, loans, transportation, or education costs. After that, add expenses that you would like to make this month as well as categories like entertainment and eating out. Set aside a small amount of money for your vacation (even if it is only $15 and even if you are not planning a trip within the next 6 months).

After that, distribute money from your income for basic expenses. As you imagine paying for them, cross out the categories of expenses. If you want, write down the amount you spent next to it. Try to distribute the remaining funds in the same way between other categories of expenses.

Check to see if your income is enough for everything, whether you can save money on some categories to redirect the funds to another category of expenses or put it to the piggy bank. Perhaps after creating the list you’ll see invisible at first glance categories of expenses that you’ll want to ditch.

✅ Tip: You can put stars next to the categories of expenses that can be optimized. For example, there are many ways to reduce utility bills if you use meters, energy-saving lamps, aerators for mixers, and if you unplug appliances that you don’t use from the circuit. Sometimes service companies offer a system of discounts on certain conditions.

At first glance, it might seem that optimizing your expenses looks too hard and that it’s even senseless. But imagine that a family consisting of several members unnoticeably spends a bit more than $5 for themselves: that can be a bill for water that comes from a leaking tap, forgotten and spoiled vegetables lying in the depth of your fridge, a small overpayment for a loan that could be refinanced, buying a pack of chips as a snack or an unnecessary toy that a kid forgets about right after you buy it.

If you optimize your expenses on the little things and save about $5 a day, then you’ll save about $150 a month, and about $1,800 a year that could be spent for a family vacation by the sea.

Choose a suitable method to control the budget

The traditional method is all about writing down your income and splitting expenses into fixed, periodic, and variable expenses.

- Fixed expenses are expenses that don’t change (the amount and the timing). It can be rent or a loan payment that normally doesn’t change monthly.

- Periodic expenses include the spending that happens from time to time. It can be tax payments or buying stationery goods for the new study year. People tend to forget about periodic expenses —which is why they can hit the family budget quite hard.

- Variable expenses are the ones that insignificantly change month by month. Those can be utility bills or car services.

✅ Tip: For convenience, you can calculate the average for periodic and variable expenses based on invoices for the last 6-12 months and use this number when planning expenses.

After that, you need to set the budget while taking into account each category of expenses and optimize them if necessary.

For this method, you need to have as much information about each type of expense as possible which is why it’s necessary to write down your expenses every day. By doing this, you will be able to control every penny spent and get a clear picture of your expenses with a chance to analyze and adjust them. Unfortunately, this approach requires a lot of time and meticulous calculations.

Perhaps you’ll find the envelope system more convenient to use. For that, take several envelopes and write down the spending category on each of them. For example: “utility bills,” “transport,” “products,” “entertainment,” and “savings.”

Distribute your monthly budget between these envelopes: place the amount of money in each envelope that you are planning to spend on this category. Prioritize them: first fill the envelopes that relate to necessary payments, products, and important purchases. Then distribute the rest, leaving a part for unexpected expenses or pocket money, and keep the second part for savings.

When paying for a service or product, make sure to only use the money that is there in the envelope meant for this type of spending. It might sound simple but sometimes the opportunity to feel the amount of money left physically helps relate to financing more seriously.

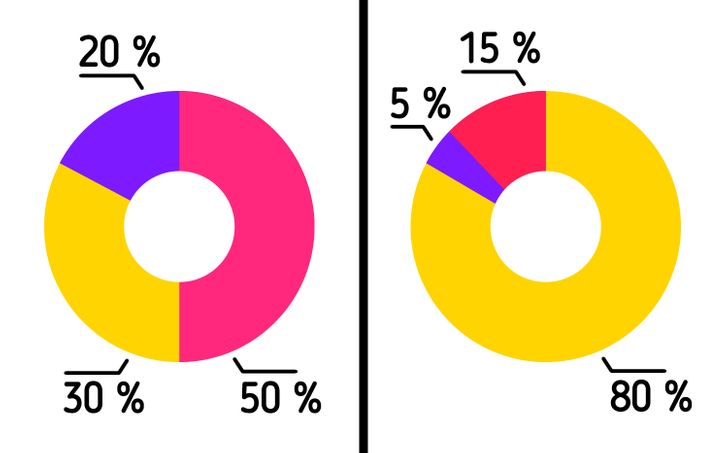

You might also find the method based on the 50/30/20 rule useful. According to this rule, you need to split your entire monthly income into 3 parts:

- 50% goes to your needs (food, shelter, utilities, etc.)

- 30% goes to your whims (trips or eating out)

- 20% goes to your saving account or investments

The proportions might change depending on your income and spending: you can allot 80% of the budget for your needs, 15% for your whims, and only 5% for savings and investments.

This method seems simple but it’s hardly suitable for beginners who are not always able to clearly separate their needs from their whims. For example, visiting a hairdresser, buying sweets and delicacies, an evening out with friends, or drinking a cup of coffee after work relates to the second category while paying loans can be optionally transferred from the third category to the first one.

There are many varieties of this method. One of them is based on the 80/20 rule. It says that having received a certain income, you should multiply it by 0.2 and immediately set this amount aside as savings. The rest is used to cover all existing expenses.

✅ Tip: You can follow optional recommendations from different methods of budgeting. For example, you can first distribute your expenses by the 50/30/20 rule and then use the envelope system and allot a separate envelope and a certain budget for each spending category.

Watch your spending within a year and analyze it.

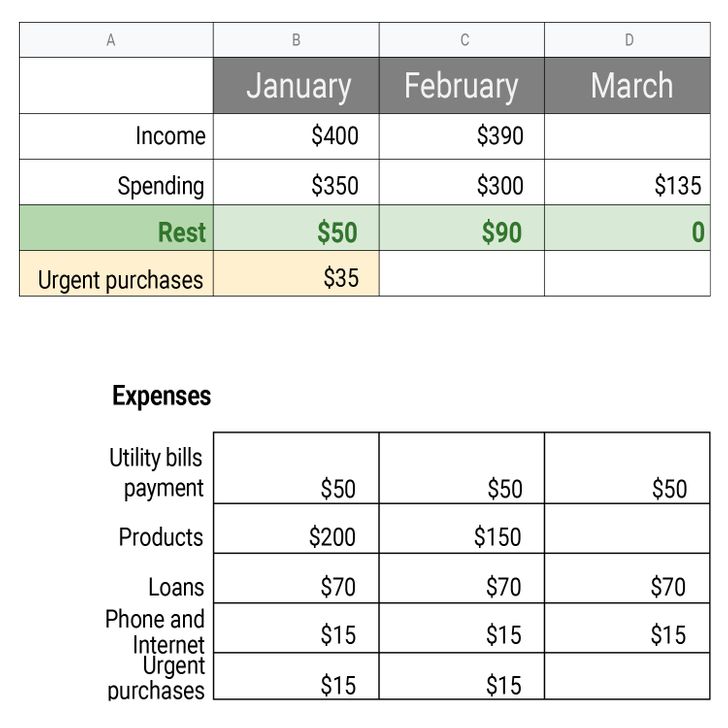

It is more convenient to monitor your spending and budget status throughout the year using Excel spreadsheets. In the picture above, you can see one of the simple examples of organizing a budget file.

- On top, there are the names of columns, indicating expenses, spending, the rest, and urgent purchases.

- In the chart below, you can see more detailed categories of expenses.

- The columns have the names of the months written on top of them. Depending on the month, the necessary slots of each column are filled.

Example: The income in January was $400. A part of this money went to utility bills ($50), other parts were spent on buying products and detergents ($200), on paying out a loan ($70), and paying the phone and internet bills ($15), also a small amount was saved for urgent purchases ($15) no matter whether you had them in this particular month or not. In total, the expenses were equal to $350 and that is written down next to the income line. Below is the balance obtained by deducting the amount of monthly obligatory expenses from the monthly income. This is the amount that can be spent on buying a new piece of clothing or going to the movies. The last line is for “urgent needs” where you sum up the money saved for urgent purchases. Thus, even with a modest income, you can distribute funds, pay off debts, and create a savings if you track your expenses properly.

❗It’s important: Even if you have a loan and you want to use as much money as possible for paying it off, don’t neglect the opportunity to put away some, even if it’s an insignificant amount of money, for urgent needs. For example, if you save about $20 every month, you’ll have $240 in your piggy bank by the end of the year.

Try buying in bulk to spend less.

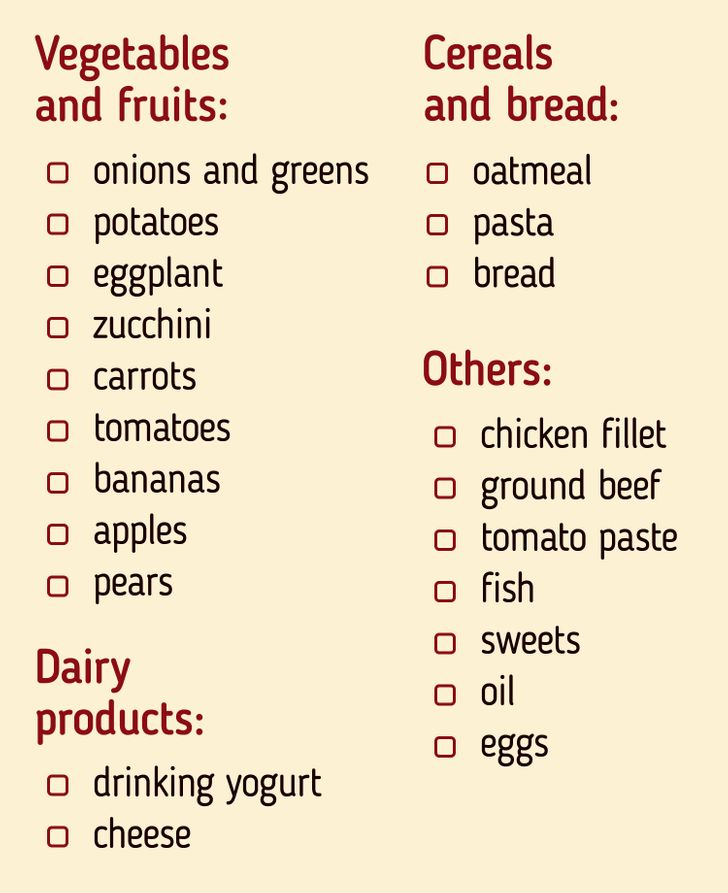

A significant part of spending usually goes to food and household detergents. Therefore, it is convenient to immediately plan purchases by creating separate lists for groceries and household detergents when distributing the family budget. This will help you avoid unnecessary expenses and adjust to different discounts and sales in stores over the next 30 days.

What to do: Write down what you need to buy for a week, a month, or even 6 months on a separate sheet of paper, taking into account the shelf life of products and their price. For example, if there are good discounts for grains and pasta in stores, it will be better to buy these products in bulk and cross them off of your shopping list several weeks ahead because they have a long shelf-life.

✅ Tip: You can grow various types of greenery and lettuce at home on your windowsill. This will save you money and you can be confident that you and your family are eating clean food.

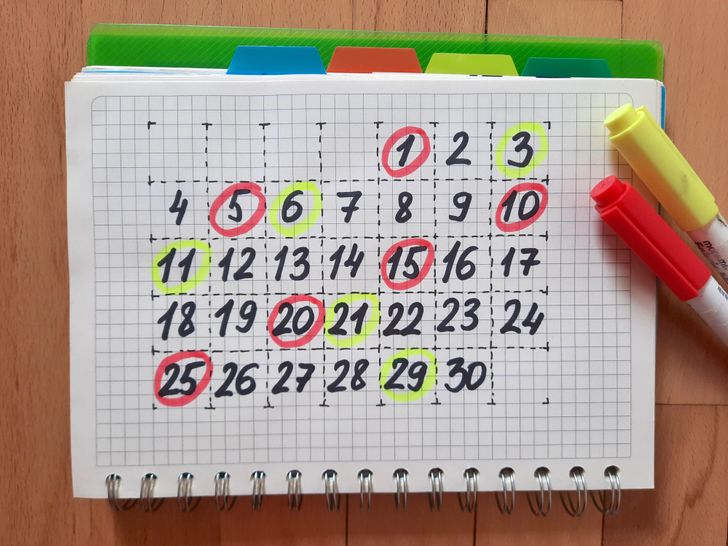

Create a calendar of your expenses.

The visualization of payment days can be useful for several reasons: you won’t forget to make the payment on time, you will be able to see the schedule of all your expenses and plan other spending based on it. For example, if you know that you’ll get a bill for paying for a certain service on the 20th of the month, but it can be a bit bigger or smaller than what you expect, it’s useful to add it to your calendar and perhaps set aside a small amount of money just in case.

What to do: Use a ready-made calendar or draw one yourself. Mark the dates for when you need to pay for something or make a planned large purchase in red. If you wish, you can write what exact purchase you mean.

✅ Tip: If you often make unplanned purchases that negatively affect the family budget, add the dates marked in yellow to the same calendar. These will be the days when you won’t be allowed to spend money that is not according to the plan. Oftentimes, that’s enough for you to be able to refuse impulse spending.

Save every penny.

People oftentimes underestimate the value of small money lying in bags and pockets. If you collect all the coins and put them in one place, and then take them to the bank every 6 months or every year, or put them in a machine that exchanges small change for bills, you can discover a fairly large amount of money.

Put a small jar or an old mug next to the front door. Put all your coins there until the jar is full. Afterward, change all the coins into paper bills at a bank or with the help of special vending machines available in malls. Also, the presence of this jar near the front door will be helpful when you need change for the courier or some coins for pocket money for your kid.

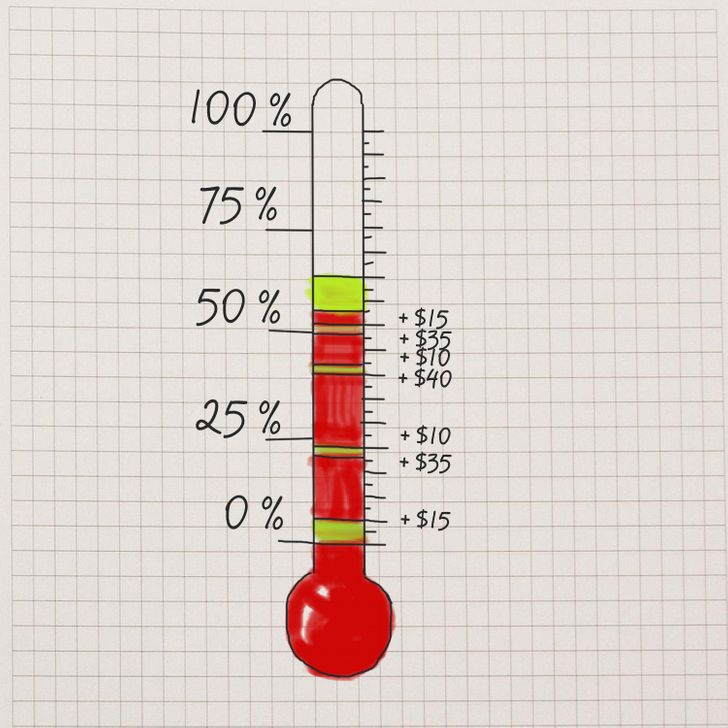

Get rid of debt and create a savings for various goals at the same time.

Never postpone loan payments. If it is possible and profitable under the terms of the agreement, make a little more than the minimum monthly payment in order to gradually pay off the debt. Imagine it’s an ordinary financial goal that you are saving money for. Don’t neglect coins and small bills — any amount matters.

What to do: Draw the debt repayment scale as shown in the picture above. The left part of the scale shows the status of paying off the loan in a percentage format. As you pay off some amount, paint over a part of the scale. If you wish, you can write down the number of payments in the money format to the right of the scale. Hang this picture in a visible place to fill the scale and visually understand the size of your debt and watch the progress.

✅ Tip: This scale can also be drawn to watch the status of your savings for a certain goal like a vacation or presents for your family. Place a jar for money next to the picture so that all family members can make a contribution, or you can save money in a virtual account.

Some people find it easier to put aside a small amount of money on a daily basis instead of allotting a big amount at once. In this case, you can use the following method:

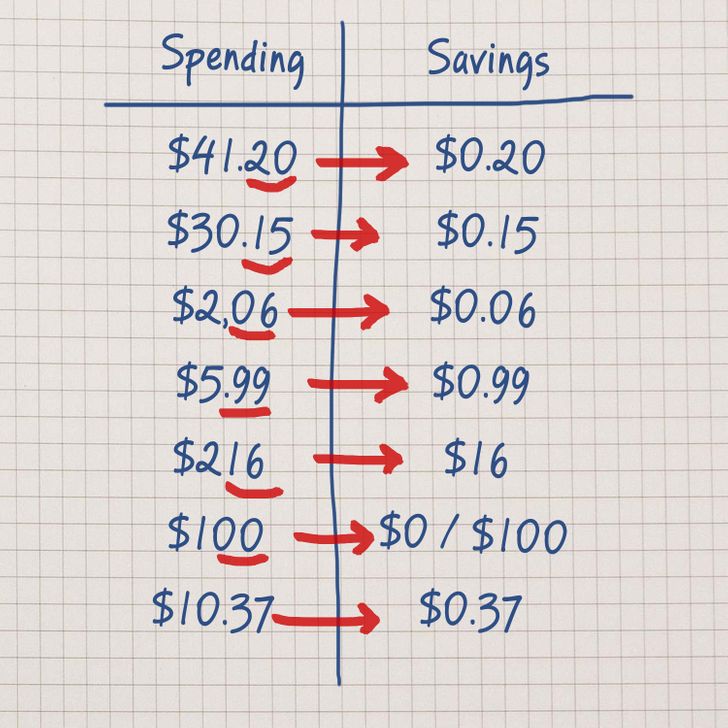

- Divide a sheet of paper into 2 parts. Call the left column “Expenses” and call the right column “Savings.”

- In the left column, write down the total amount of your spending per day. Look at the example above: the first line says $41.20 — the amount that a person spent within one day.

- At the end of the day, write down the last 2 digits of your daily spending throughout this day in the next column. The number that you get is the amount of money that should be put aside as a part of your savings. For example, the last 2 digits in the second line ($30.15) are 1 and 5, which means that you need to put $0.15 into your piggy bank on that day.

- When the last 2 digits are 2 zeroes, it’s up to you to decide whether to put $100 or nothing in your piggy bank.

- Save money based on your own capabilities. If on a certain day the amount for the piggy bank seems too big to you, then you can put a minimum amount. The main thing is to maintain the habit of saving money.

At first glance, it might seem that you will only be able to save a small amount of money by doing this. If we judge by the example above, we will see that a person will be able to save only about $18 per week. But this sum can grow into $1,000 or even more after a year (depends on how much money you’ll be saving). This is a good way to secretly save money for gifts for the whole family for Christmas. Even if this is not enough, it is always easier to add some amount to what you have already saved.

✅ Tip: Even with a modest income, it’s useful to save funds by creating emergency savings that will be there to help in a difficult situation. First of all, set a goal for yourself to save a certain big amount of money ($1,000 for example). After that, you’ll be able to gradually increase it. It would be perfect if your emergency savings will be able to cover your basic expenses from 3 to 6 months. Once the emergency savings are formed, think about how to profitably save the funds. That can be a saving account where you’ll be gradually adding money or a special plan for saving.

Try to create additional sources of income for yourself and other family members.

The more opportunities to earn money you have, the higher are your chances are to form an emergency savings account and live through the crisis that happens when someone loses their main source of income.

Think about how you can earn money in your free time. Perhaps you have a hobby and know how to do some crafts like knitting, drawing, clay modeling, or repurposing old clothes into something new and functional. The result of this hobby can be sold. Create your crafts from time to time and put them for sale.

It’s likely that there are many things in your home that it’s time to get rid of by selling them too. They can be old shoes and clothing that your kid has outgrown, unnecessary furniture items, or outdated technical appliances.

Also, this can be a periodical or a one-time earning: excursions around the city, selling Christmas trees before the holiday season, or services on how to create nice presentations.

✅ Tip: Depending on your country of residence, you may be eligible for certain benefits, including tax deductions. In this way, you can return part of the money spent to the family budget.

Engage all family members in the process that will teach them how to save funds.

You can arrange an unusual game in your family circle thanks to which one of you will be getting extra money to spend on anything you want.

Step #1. Take any jar. It’s better if it is transparent so that you can see its contents.

Step #2. During one month, each family member puts a small fixed amount or a percentage of the income received into the jar. The amount can be different for each family member or the same for everyone — it’s up to you.

Step #3. At the end of the month, you write down the names of the family members on a sheet of paper and put them into a hat. Then the oldest or the youngest family member pulls out a random piece with a name on it. The person whose name happens to be on the sheet gets all the contents of the jar and can spend it at their own discretion.

Turn your kids’ savings into an interesting game.

Variant #1. This game will help a young child visualize and compare their income and expenses, even if they don’t know how to add and subtract numbers yet.

- Draw a snake’s face on a piece of paper, then draw its body and tail the way it’s shown in the picture above.

- Secure the drawing in a visible place. Invite your child to paint over the snake’s body together with you every time they receive pocket money. To make the process more convenient, you can draw a striped snake where each part of its body equals a certain amount of money. For example, $1.

- When the child spends money, you erase the shaded area together on the snake’s body that corresponds to the expense.

✅ Tip: For this visualization, it would be more convenient to draw with markers or chalk on a special board that you can easily paint over or where you can erase parts of the snake.

Variant # 2. This method will help the child think more about spending the saved money.

- Take a small plastic container like a mayo jar. Invite your kid to use it as a piggy bank where they will store their coins. You can make the first contribution by placing several coins on the bottom of the container. After that, cover them with a small amount of water and place the container into the freezer.

- Now it’s your kid’s turn to act. In order to top up the piggy bank, they will have to take the container out of the freezer, add coins, cover them with water, and put them back in the freezer.

- When the container is full, the ice with coins can be taken out of the freezer and defrosted. Or you can start to fill a new container, keeping the first one as is.

The advantage of this piggy bank is that it’s quite problematic to instantly take the money out of it. Your kid will have to wait and exert effort, which will give your kid time to think about their impulse spending.

Variant #3. With this game, you will encourage your child or teenager to not give in to the desire to spend all their savings on the way to their financial goal (like buying a game console, for example).

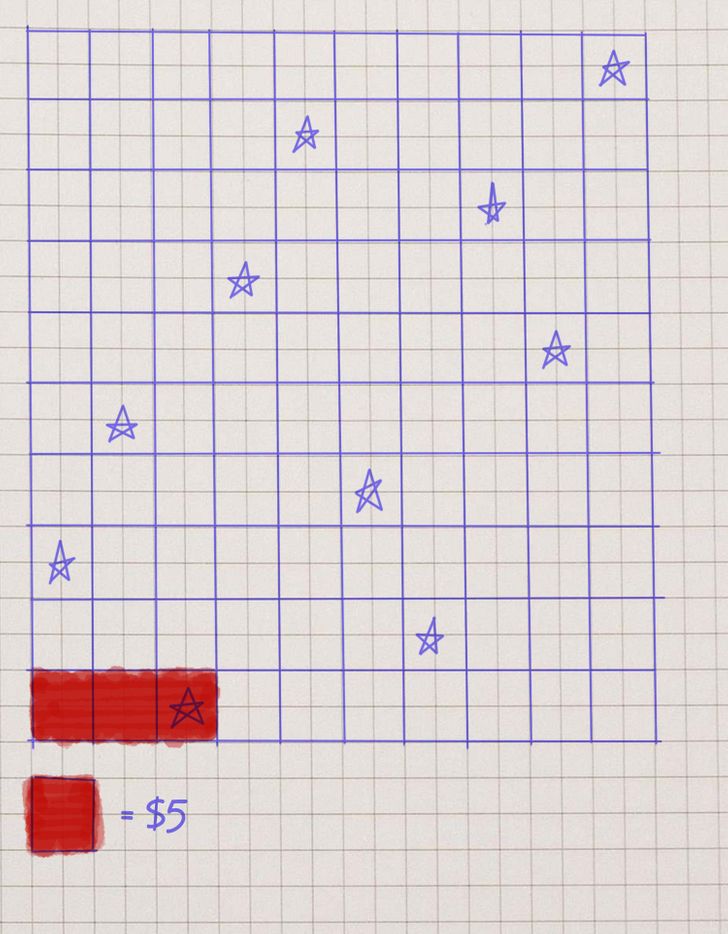

- Draw a 10×10 chart. Invite your kid to randomly draw 10 stars on it — one on each line or column.

- Next, take a piece of paper and cut it into 10 strips. Write down the reward the child is entitled to on each strip — it will be a motivation for saving money. It’s better to be something non-material like watching a favorite movie together, visiting the master class on some craft, or the opportunity to throw a party at home. Think up the rewards together with your kid.

- Put together all the strips into a jar or a mug. Secure the chart in a visible place. Place a jar or another container where the kid will be putting their money under the chart. Place the jar with rewards and a marker next to the first jar.

- Agree on the meaning of one cell in the chart. It can be $0.5, $1, or $5. At the very top of the chart, you can optionally specify the amount that will be there in the piggy bank when the entire chart is filled.

- When your kid puts money into the piggy bank, they will paint over the squares in the chart gradually moving from left to right and from bottom to top. When painting over a cell with a star, they will take out a piece of paper with a reward written on it from the jar standing next to it. When they paint over all the cells in the chart, your kid can take all the money from the piggy bank and spend it the way they want.