How to Learn to Save Money Without Limiting Yourself Too Much

When we have to save money, the most unpleasant thing about it is having to give up stuff we enjoy the most.

5-Minute Crafts has found ways to help you save money without limiting yourself too much.

Keeping track of your expenses

Understanding what you spend money on is an important step to saving money.

The easiest way to do it is to get a notebook or download a special app. It’s important to make tracking expenses a habit. At the end of the month, you can compare your income with your expenses. It will help you get a very objective view of your current financial situation.

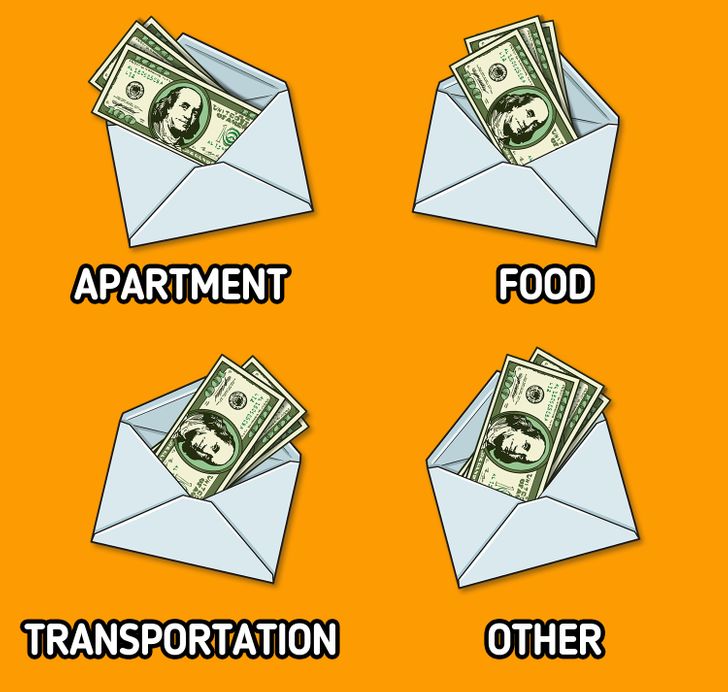

Planning your expenses for a month

Planning your monthly expenses helps to keep the situation in check.

You should calculate your monthly expenses on transportation, food, bills, and other constant expenses. A very effective way to do this is to make separate envelopes for every expense and try not to spend more money on each category than you initially put into the envelope.

Shopping online

Shopping online is often more economical than ordinary shopping. In online stores, the prices don’t include the rental price, electricity bills, and the salaries for cashiers. Also, online stores often give discounts for their products. They work non-stop and save a lot of time for their customers.

Considering these factors, think about the things you can buy without leaving home.

Coupons and discounts

Modern retail chains often offer good prices for buying products with coupons, discounts, and other systems. Gyms, dance studios, and other similar places often sell memberships you can save a lot of money with.

The money you can save this way might seem unimportant, but if you regularly use such offers, the amount of money you can save is significant.

Shopping list

Don’t underestimate the importance of shopping lists.

Every time you go to the store, make a list beforehand. The worst thing you can do to your budget is buy something impulsively, so always stick to a plan. If you think that buying a pack of gum isn’t a big hit to your budget, imagine how much money you’ll spend if you always make such small unimportant purchases.

Paying cash

Paying with cash is much more economical than paying with a card because using cash makes it easier to stay within your plan.

Using a credit card increases the risk of impulsive purchasing. When we use cash, we literally see the money fly out of our pockets, so it makes it harder to spend.