How to Plan an Effective Budget

Having a budget is a great tool you can use to control your personal or family finances. If you have enough money, a budget will help you improve the situation and achieve your goals. If you don’t have enough money, you will be able to deal with your debt and ensure financial stability.

We at 5-Minute Crafts have analyzed the recommendations of experts and come up with our own way to plan a budget. It’s universal and it helps you to control both your personal and family finances.

1. Analyze your expenses

-

Before you plan your first budget, you need a month to prepare. Write down all of your expenses during this period: from buying a loaf of bread to paying for a gym membership.

-

You can find information about your expenses from your mobile bank app if you paid by card, or paper receipts if you paid by cash. Don’t forget to keep all of your receipts.

-

In order to write down all of your expenses, you can use special mobile apps, online services, Excel, or Google Docs.

-

At the end of the month, analyze your expenses and sort them by categories: food, bills, internet, cell phone, beauty products, medications, clothes, shoes, and other. Everyone will have their own list of categories that is necessary to create a monthly budget.

2. Analyze your income

-

Together with your expenses, write down your income. This is especially useful if your income is not regular and you only know an approximate amount for how much you earn each month.

-

For every kind of income, make a separate category. It could be a paycheck, bonus, income from rent, interest, or even cash back.

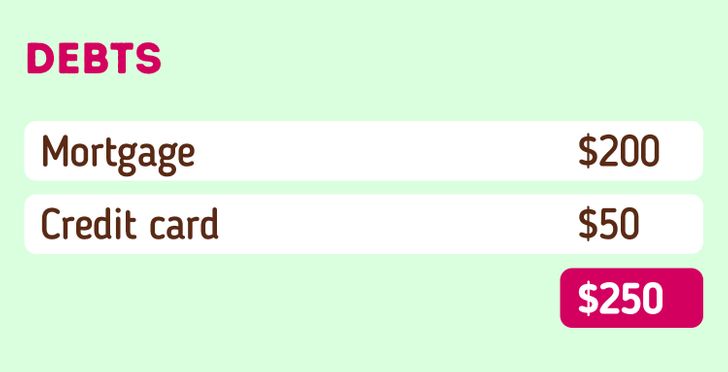

3. Analyze your debts

Make a list of all your debts, loans, and credit cards. Count the amount of money you have to pay every month.

4. Make a plan for the month

After you’ve counted all your debts, income, and expenses and you’ve categorized them, plan your monthly budget:

- Count how much money you need to have to pay for all of your loans.

- Plan all the important monthly payments you can’t avoid: food, bills, cell phone, internet, and others.

- Make a list of expenses you could theoretically get rid of if you had to. For example, going to the movies or cafes.

- For every category, write down the amount you spent last month. Try not to plan an exact amount and add 10% to every sum. This way, you won’t be nervous that you are spending too much.

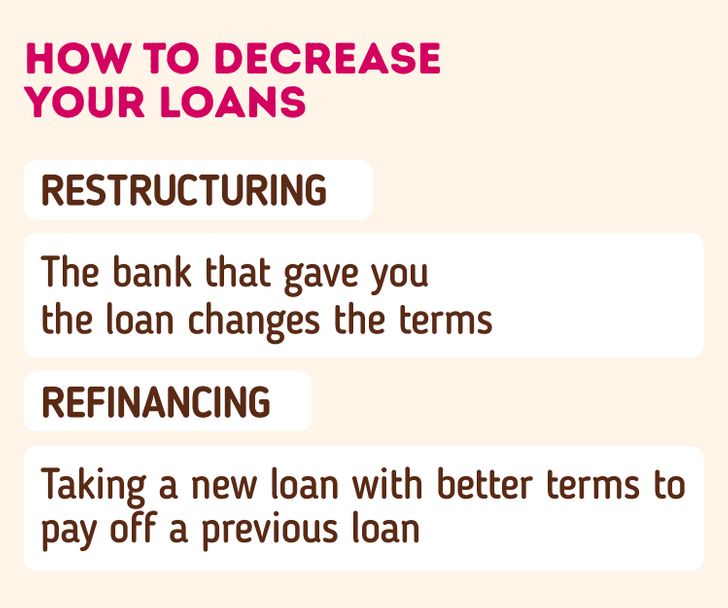

5. Optimize your debts

2-3 months after planning your budget, you will have a clear picture of your financial life. If you think everything is okay, you can skip this and the next points. If not, here is a shortlist of what you can do to optimize your debt:

- If your debt takes a lot of your budget, you should consider restructuring or refinancing.

- Restructuring is when you change the terms of your debts. For example, you can increase the duration of the loan and decrease the amount per month.

- Refinancing is getting a new loan with better terms to pay off the previous one. You can get a new loan at the same bank or at a different bank where the terms are better.

6. Optimize your income and expenses

-

If you have several sources of income, calculate how much time you spend on each of them, and calculate the cost of one hour of your work. To do that, divide the income you get per month by the number of hours you work. Compare the incomes from different sources. Maybe it makes more sense to give up one of the jobs you have, to be able to do the other one more.

-

The biggest thing you can do is optimize your expenses. Aside from following the tons of different recommendations that you find online, you can revise all of your expenses. Think about all the categories and how much you really need each of them. For example, do you go to an expensive restaurant because you really like the food there or just because you need a place to talk to your friend? If it’s the latter, choose a cheaper place or just go for a walk together.

7. Form a habit

-

Continue keeping track of all your expenses and turn it into a habit. This way, you will always know how much money you make, how much you spend, and exactly what you can save on if you have to.

-

Make a monthly plan. It will make it easy to plan big purchases.

-

Optimize your budget regularly. Do it every 4 months for the first year, then every year. Maybe you will see that some categories are not even necessary at all and you can remove them.

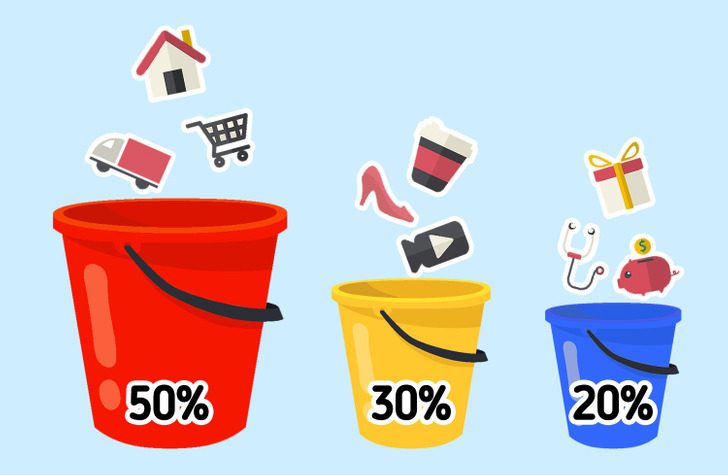

8. Try the 50/30/20 budget rule.

The 50/30/20 budget rule is a money-saving strategy. You can use it to divide your income into the categories of needs, wants, and savings:

- 50% of your income should be spent only on must-haves and essentials (mortgage, rent, groceries, utilities, health insurance, transportation, loan minimum payments, child care, etc).

- 30% should be spent on your wants (dining out, vacations, movie tickets, concerts, Netflix and other subscriptions, nonessential clothing and services, hobbies, etc).

- 20% should be kept for savings (emergency funds, savings accounts, investments, gifts, etc).

This is a very simple budgeting strategy, but it won’t work if you have very low or high incomes. In other cases, it will help to keep an eye on your spending without the need to create a detailed budget plan.