How to Save Money

A new house, a new car, a college education, a vacation, and other big expenses require big sums of money that can be hard to collect in a short period of time. So, we have to take out a loan, put it on a credit card, or try to save some money up if we want or need to spend money on these things.

5-Minute Crafts has collected the recommendations of experts about the popular methods of saving up money. These methods will help you save a part of your income in order to reach your goals.

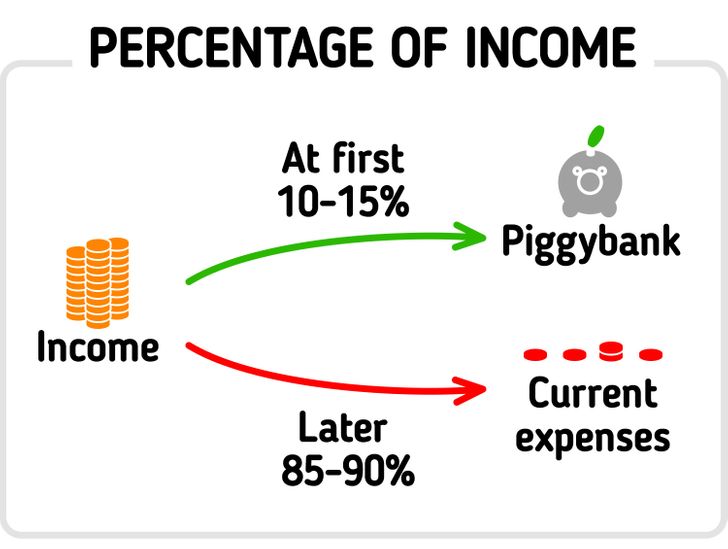

1. Percentage of your income

Every time you get your paycheck, put aside 10-15% of the amount and use the rest of the money for your regular expenses. You can replace the percent of the amount with a fixed amount if you want and set the automatic money transfer to a savings account in your bank.

➕ The advantages: You can easily predict how fast you can save up a certain amount.

➖ The disadvantages: This is good only for the most disciplined people. You have to be ready to not use a certain part of your income and fight the temptation to spend it all.

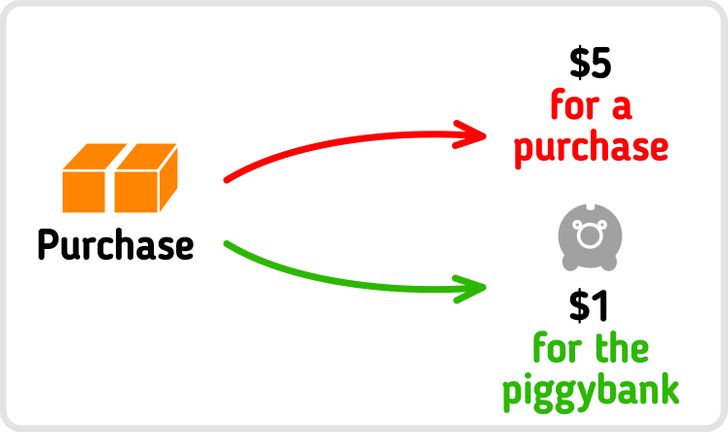

2. Piggybank on your bank account

Set up an online piggybank on your bank account. It will allow you to make an automatic money transfer to a separate bank account. The transferred money is a percentage of a fixed amount from every purchase you make. For example, you buy a burger for $5 and $1 goes to a savings account.

➕ The advantages: You don’t need to have a lot of willpower. This is perfect for people who are not ready to count their whole income and expenses and make money transfers to savings accounts. These accounts get bigger after every time you pay with your credit card.

➕ The disadvantages: It’s hard to predict how fast you can save up the necessary amount because it will depend on how much you spend, which varies from month to month.

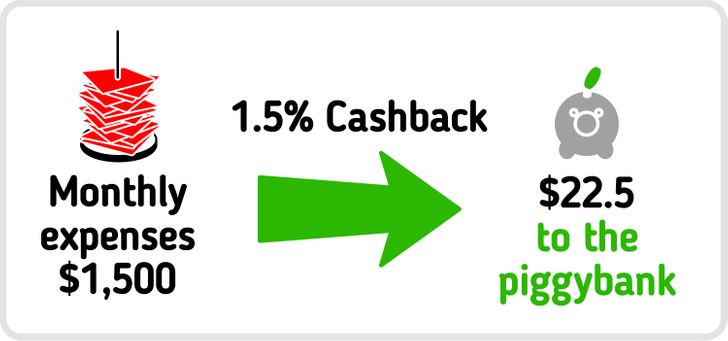

3. Cashback

Get a credit card with a cashback feature that is paid in real money at the end of every month. Transfer the amount of the cashback to your savings account.

➕ The advantages: You’re not saving your own money, but the bonus from the bank.

➕ The disadvantages: It’s hard to predict how fast you can save up the necessary amount because it totally depends on how much you spend and the percent of cashback the bank offers.

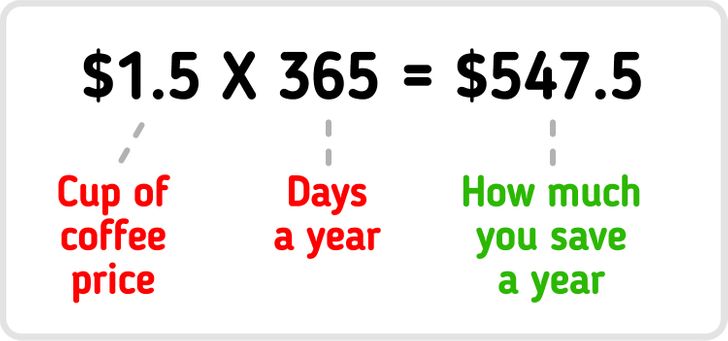

4. Removing one expense

Stop buying coffee to go or a chocolate bar every time you go to work and transfer the money you save to a savings account.

For example, if you drink a cup of coffee every day and it costs $ 1.50, it means you spend $ 547.5 a year on coffee. This is good money that could be used to buy something you want.

➕ The advantages: This is a great way to repurpose some of the money you spend and use it for something you really need.

➕ The disadvantages: It may be hard to cut down on coffee or you will need to replace this coffee with the coffee you make at home. Of course, the final amount you save will be less because of the money you spend on buying a thermos mug, coffee beans, and other stuff.

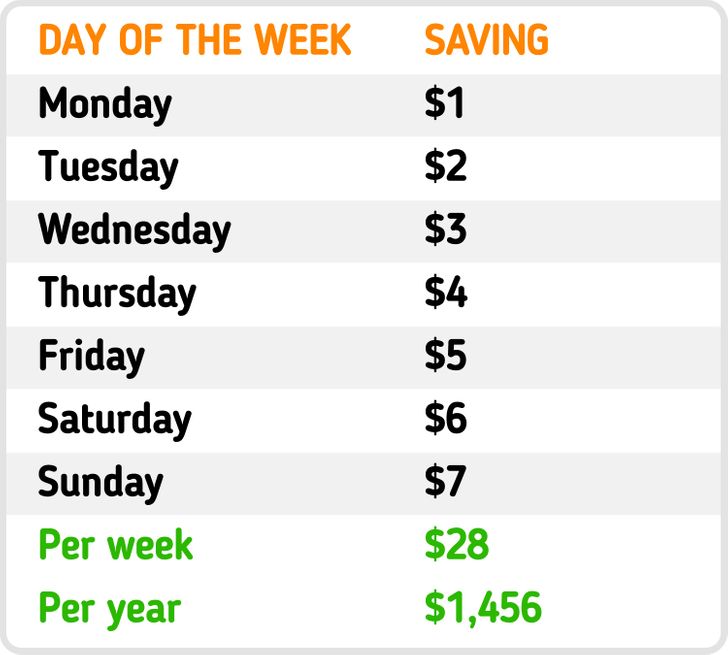

5. “365 method”

On Monday, put aside $1, on Tuesday — $2, on Wednesday — $3, on Thursday — $4, on Friday $5, on Saturday — $6, on Sunday — $7. When the next week starts, repeat the cycle and keep doing it for 52 weeks. At the end of the year, you will have $1,456.

➕ The advantages: You know the exact time and the exact amount you save. After a year, a strong habit of saving money will be formed.

➕ The disadvantages: The amount may not be enough for your financial goals and it takes a long time to save this amount of money.

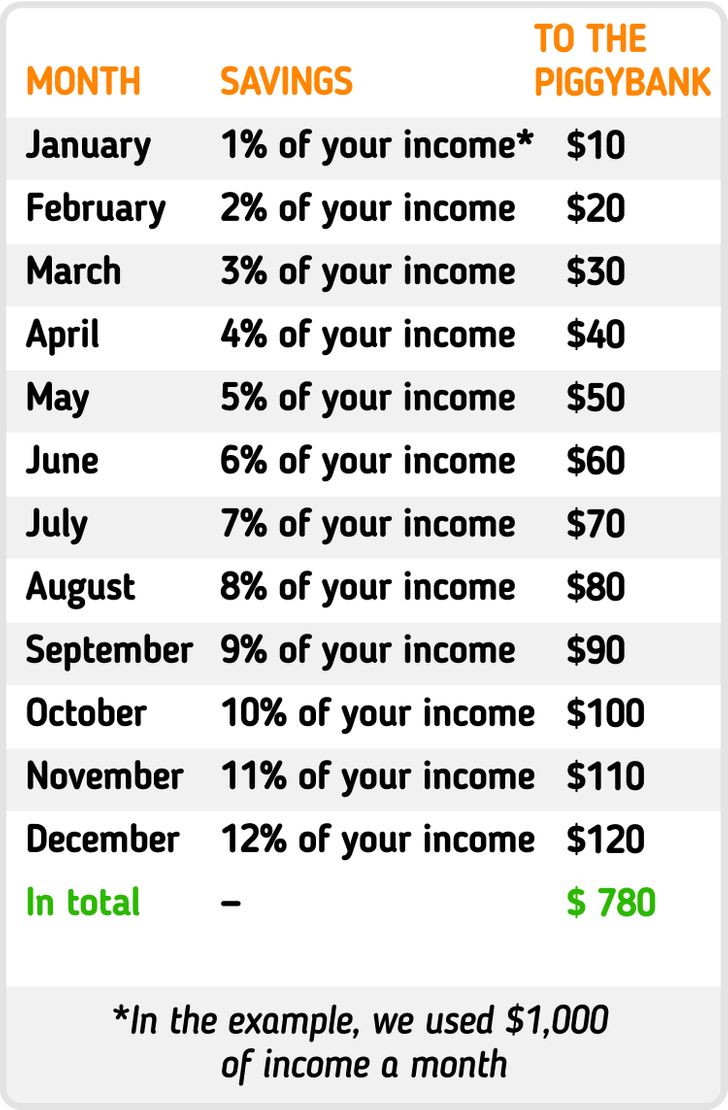

6. Combo: “365 method” and percent of your income

You can increase the amount you save if you combine the “365 method” and the percent of your income. The point is simple: put aside a percent of your income based on the number of the month. So, in January — 1%, in February — 2%, and in December — 12%.

➕ The advantages: A saving habit will gradually form. And the money you put aside at the beginning is not a lot, which lowers the chances of you giving in to the temptation and spending all of your savings.

➕ The disadvantages: The end result depends on your income level and it takes a long time.

Useful recommendations

-

Before you start saving, set a financial goal, the necessary amount, and the duration. This will give you a clear picture of when you will need the money and how much. It will also allow you to choose the right way to save.

-

Put aside the money in a savings account or a CD (certificate of deposit). You will also earn the interest the bank gives.

-

When choosing a bank for the deposit, choose those that offer capitalization — which is when the interest you get is added to the deposit amount. So, in the next month, you will get the interest off the original amount and the interest you already received.

-

Make sure the deposit can be increased, it means you can regularly add money to it. Also, there should be some penalties for withdrawing the money before the term of the deposit ends. This will decrease your temptation to spend it all.