How to Start Investing

Investing, especially in the stock market, can seem like something that is too complex to do independently. In reality, everyone can figure it out, you just need to carefully study the details.

5-Minute Crafts would like to tell you how to start investing: from setting a goal and choosing the tools to planning and your first actions.

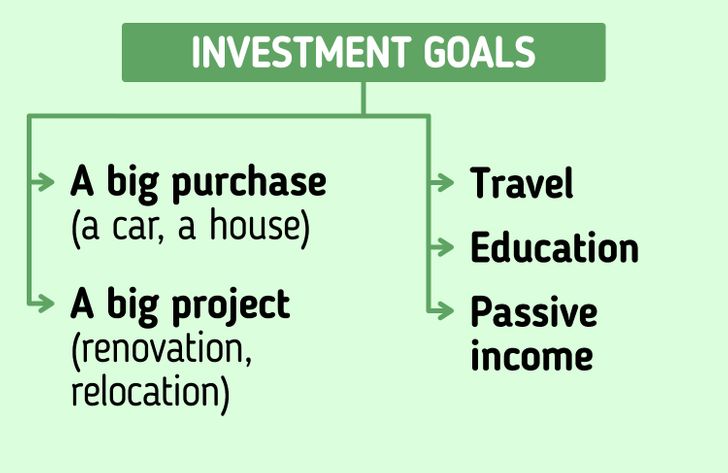

1. Setting a goal

Any investment should have a goal. Without it, you risk to spend your savings on the first thing you like. Here are some examples of goals that you can choose for your future investments:

- a big purchase (an apartment, a house, a car, or appliances)

- a big project (renovation, relocation to another city or country)

- travel or vacations

- education

- passive income

- retirement

2. Get rid of big debts

If you have loans with an interest rate higher than the estimated return on investment, close them first. Otherwise, you will remain in the red, because the interest on debt will be higher than the capital gain from your investments.

3. Build up an emergency fund

Emergency funds are designed for emergencies, like job loss, sudden health problems, breakage of big appliances, etc. Having a fully stocked emergency fund in an accessible savings account is a huge financial priority. You want to have 3 to 6 months’ worth of living expenses tucked away. Emergencies happen all the time, and having the capital to deal with them is a necessity.

Investing without an emergency fund is risky. You could end up having to sell your assets at the first emergency. This way, you could lose part of their value if the assets drop in price at the time of sale.

4. Choose your investment tool

-

Cash. This also includes cash equivalents. Cash is considered the safest investment because its value is usually steady, even when taking into account inflation. For an easy way to expand your cash reserves, invest in an interest-paying savings account.

-

Real Estate. Investors usually buy it for resale or rent. Reselling allows you to profit from the difference between buy and sell prices, while renting becomes your regular income. However, you should bear in mind that investing in real estate requires significant time expenditures and a large initial capital.

-

Other physical assets. These are automobiles, works of art, collectibles, gemstones, and precious metals.

-

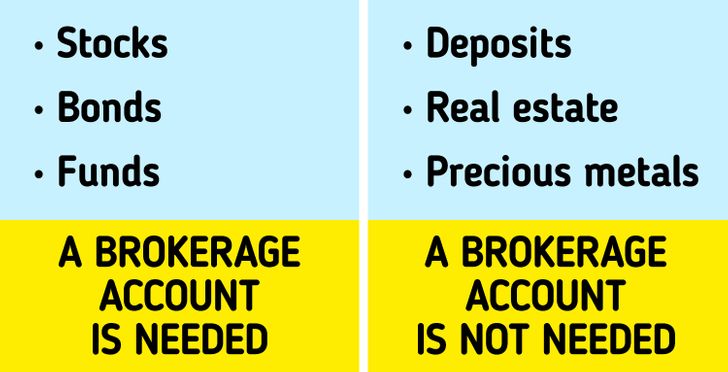

Stocks. If you buy a company’s stock, you become a part-owner and you’ll generally make money if the company does well—or lose money if it doesn’t. Stock prices can rise or fall. This way, the financial result of the investment will be the difference between the buy and sell stock prices. Besides, the company can share part of their profits and pay dividends to shareholders.

-

Bonds. When you buy a bond, you lend your money to the government, corporation, or private company that issued this security. The market price for bonds changes in the same way as for stocks, so the investor can make money on the difference between the buy and sell prices. Besides, the issuer of the bond pays interest at the rate specified in the securities prospectus. Usually, this happens twice a year.

-

Funds. These are private companies that put together ready-made portfolios of securities: stocks, bonds, etc. When buying part of the fund, you acquire a piece of the investment portfolio in the hopes of increasing its total value. Funds can help you build a balanced portfolio of securities without having to buy each one individually and monitor price movements.

You’ll have to open a brokerage account to invest in the latter 3 assets.

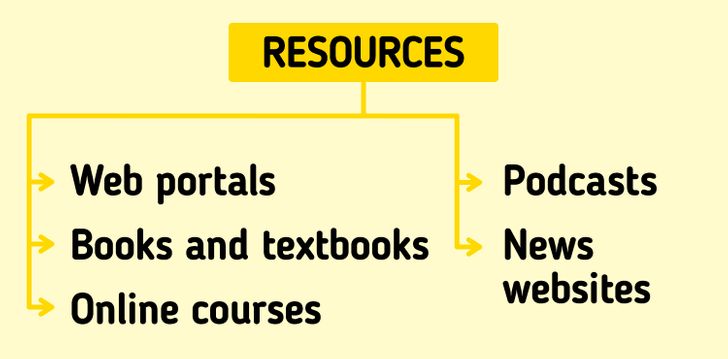

5. Study the chosen investment tool

Each investment tool has its advantages. Study them before you start investing. You can choose one of the following sources of information:

- Web portals for beginners in investing

-

Books and textbooks (for example, Benjamin Graham’s bestseller The Intelligent Investor)

-

Online courses from the biggest brokers or web portals (such as, edX or Coursera)

-

Podcasts about investing

-

Finance sites that will help you follow the latest news of the financial world

6. Find the difference between investing and speculating

An investment is an asset or item acquired with the goal of generating income or appreciation in the future. Speculation is a financial transaction that has a substantial risk of losing all value, but with the expectation of a significant gain.

An investment is characterized by:

- long-term time horizon

- moderate level of risk

- decisions that are based on fundamental and basic factors

Speculation is characterized by:

- a short timeline between the buy and sell of your asset

- high level of risk

- decisions that are based on technical charts (e.g. stock charts), market psychology, and individual opinion

Speculation carries a high risk of losing your capital, so you should be careful with it and not confuse it with investment.

7. Make a plan and start investing

-

Define your budget. Calculate what amount you feel comfortable allocating for investments. This can be a one-time payment (for example, if you want to invest your savings) or a monthly one. If you choose a monthly payment, it’s recommended to allocate up to 20% of your monthly earnings for investments. If this seems a lot, save as much as you feel comfortable, and increase the amount over time.

-

Set the deadline. Determine the period for your investments. It should depend on your goal. Some goals are long-term (such as a house or retirement), others are short-term (like travel and renovation).

-

Determine the level of your participation in the investment. Define how actively you want to take part in building your portfolio. Investors are divided into active (they choose investment tools themselves, actively monitor the movements of prices, and devote a lot of time to the process) and passive (they prefer to invest in funds where a ready-made portfolio has already been built).

-

Figure out the level of risk you are comfortable with. It’s important to remember that investing is still risky. Therefore, you should invest money that you won’t need within a few months. Also, determine what the minimal level of portfolio drawdown you are ready to accept is. Depending on the level of risk, choose more conservative investment tools (deposits, bonds) for your portfolio or, conversely, aggressive ones (stocks).