What an Emergency Fund Is and How to Create One

Your emergency fund is a certain amount of money for unexpected expenses. These expenses might appear when a person loses a job, has health issues, or if their car or some device breaks and needs to be repaired. An emergency fund will allow you to avoid taking out loans. Instead, you will have savings that you can use in a difficult situation.

5-Minute Crafts is going to tell you how big an emergency fund should be, how to save the necessary amount, where to store it, and when to use it.

Why do you need an emergency fund?

Here are some typical situations for when an emergency fund might be necessary.

- Losing a job. While you’re looking for a new job, the fund will help you stay afloat.

- Emergency treatment. If you have a tooth problem or other health issues, the emergency fund will allow you to not waste time saving for the treatment, but to get help immediately.

- Emergency repair of your car or devices. There’s never a good time to have a broken car. If you have an emergency fund, you can fix all your problems instead of taking out a loan or waiting for a payday.

- Big purchase. If there’s no way to repair a broken TV, you might have to buy a new one. And your emergency fund can help you with that.

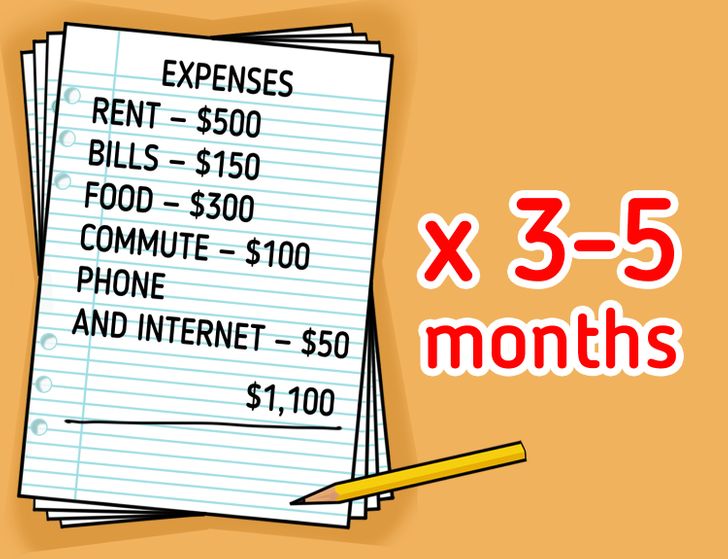

How big should an emergency fund be?

If you lose your job, you need an emergency fund to cover 3-6 months of your expenses while you’re looking for a new job. But you also might need more time if you are a freelancer or your job is seasonal. Or, less time if you have a specialty that is in demand.

To find out the exact sum of money you need, estimate the most necessary monthly expenses — for example, renting an apartment, mortgage, bills, food, and transportation. You don’t need to include the expenses you can live without: like eating out at restaurants, going to beauty salons, and others. After that, multiply the amount by the number of months you think you need. This is how you can calculate the amount of money you need.

How to make an emergency fund?

-

Decide how much money you can put aside every month. But do it at the start of the month, not at the end, or you might spend all your money. When you have your paycheck, put aside the necessary amount, and use the rest.

-

Set up the automatic replenishment of your account. This way, you won’t forget to add money to your account because the bank will do it for you.

-

Think about how you can save more. Look at your monthly expenses and choose the ones you can give up on. Direct the money to the right account to make the emergency fund.

-

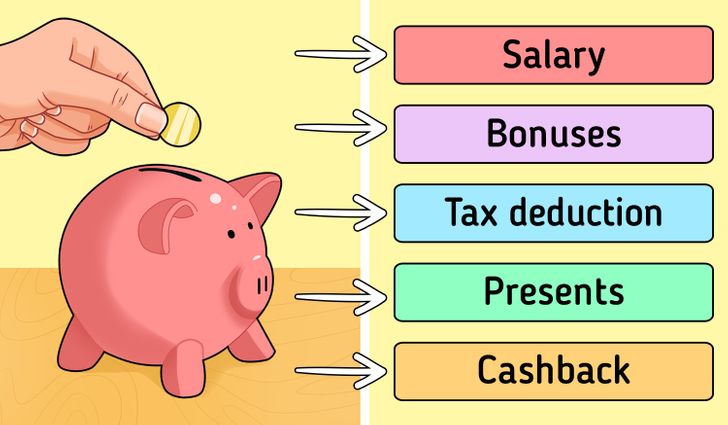

Put the additional income into a savings account. If you have an unexpected bonus, a tax deduction, a present, or cash back, you can use this money to build your emergency fund. You probably weren’t going to use this money any time soon anyway, so instead of buying something you don’t really need, put it aside.

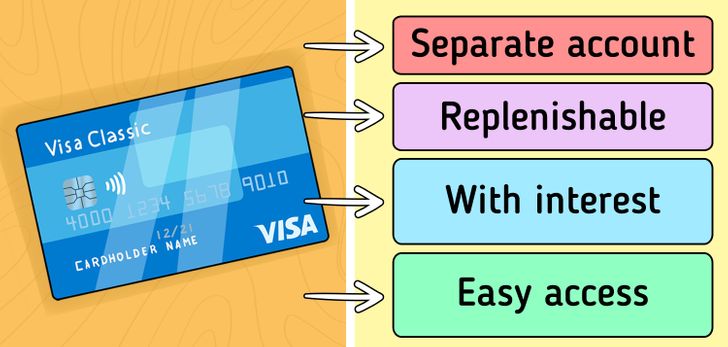

Where to keep your emergency fund?

For a bank savings account, here are some basic rules.

- Make a separate account for the emergency fund. Keeping the fund in the account you use all the time is dangerous — it will be too tempting.

- Make the deposit into an account with interest. This will help you build the fund faster. But make sure the deposit is replenishable and that you can add more money regularly.

- Make sure you have quick access to it. You could have some unexpected expenses come up at any moment, so it’s important to be able to use the money fast. There should be no fines for withdrawing the money before the agreed term.

When to use your emergency fund?

Decide which expenses you think are emergencies and which aren’t. For example, you can pay the plumber with your current expenses but if you need to get the washing machine repaired, you might need to use the fund.

If you have an emergency, don’t be afraid of using the money. This is exactly why you were saving it. But there should be rules on restoring it.

- Start saving again.

- Cut down on the expenses that are not necessary to restore the fund as fast as possible.

- Check the things you have and sell the ones you don’t need. Use the money you earn to restore the fund.

- Find another job to increase your income.