What the Numbers and Marks on Credit Cards Mean

Credit cards became something very ordinary a long time ago but the information on them is still nothing more than a series of symbols to most people. For example, we often think that the digits on the card are simply a number given to it by the bank. But in fact, it’s a cipher that hides important data behind each digit.

5-Minute Crafts is going to tell you what the numbers and other symbols on both sides of credit cards mean.

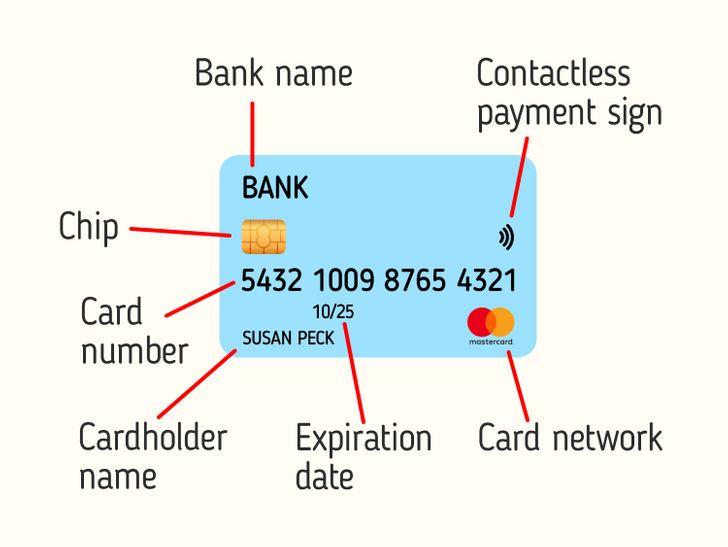

The front part

- Bank name — the logo or the name of the bank that issued the card.

- Chip — the piece that contains the information about the account and secures it from fraud.

- Card number — a unique identification number. It often contains 16 digits separated into 4 parts. It’s necessary for online purchases and money transfers.

- Expiration date — month and year when the card expires. It doesn’t mean the account will be suspended, but the client will usually receive a new card in the mail sometime close to the expiration date. Banks set expiration dates because cards may become impossible to read over time. Also, this is a way of for them to update their cards regularly with new designs and functions. Lastly, it’s a way they use to protect their clients from fraud.

- Cardholder name — the name of the person that owns the card. It’s not always the account owner. It could be an authorized user that has access to the account. For example, it could be an additional card for a family member.

- Card network — this is the logo that tells you which network issued the card. The most popular ones are Visa and Mastercard.

- Contactless payment — this means you can pay without inserting the card into a terminal.

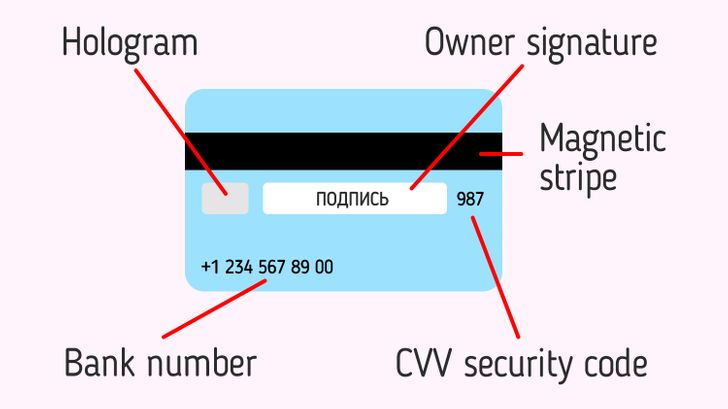

The back part

- Magnetic stripe — the black stripe that consists of millions of tiny magnetic particles and contains all the information about the client. When you swipe your card through a card reader terminal, the reader gets your account information from the magstripe and uses it to process the transaction.

- Hologram — a security feature meant to prevent the card from being physically copied. It contains several layers of images at different angles, giving it the illusion of some motion. There can also be other images hidden within these layers. The multiple layers and hidden images make the hologram difficult or impossible to copy with a scanner, so a true image can’t be created to print copies of the card.

- CVV security code — can be CVV, CVС, CVN, or CVV2. It’s a code that makes sure that it’s the owner that is using the card. It’s necessary for online shopping.

- Owner signature — in some cases, shop assistants might require you to sign something when paying. They compare the signature you gave to the one on the card to see if they are the same.

- Bank number — the phone number on the back of your card is the best number to use for general customer service.

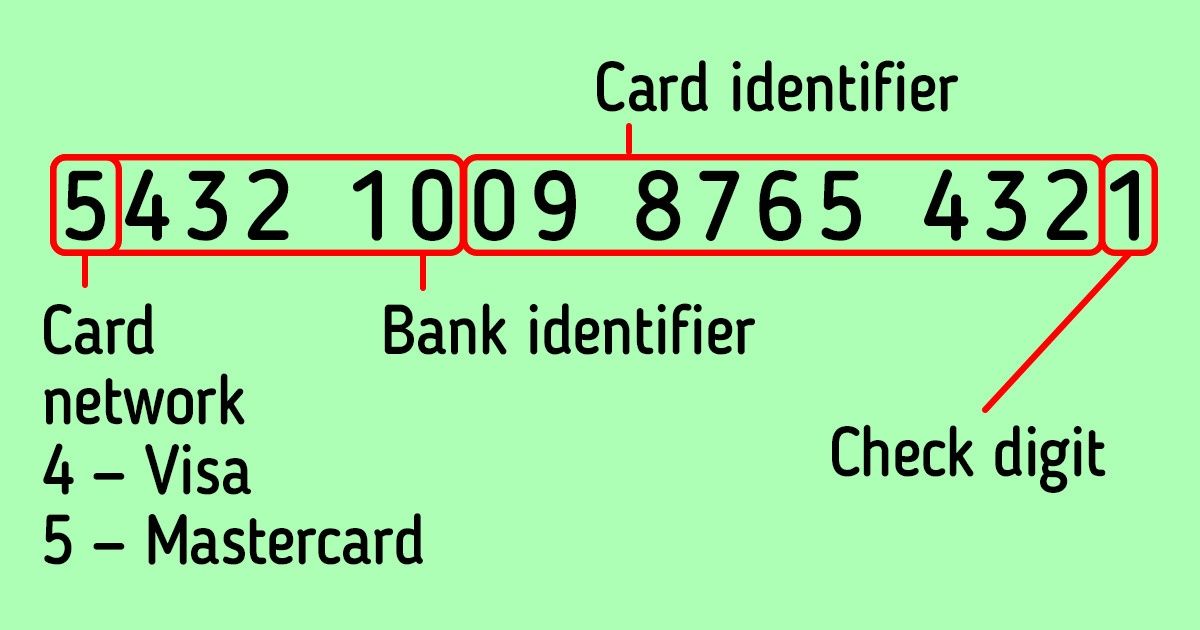

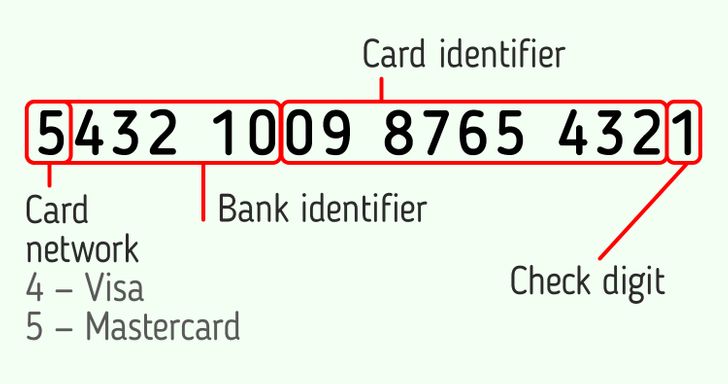

Card number

The digits that make up the bank card number contain the following information:

- The first digit is the network number. For example, Visa cards usually start with 4, and Mastercard with 5.

- Digits 2-6 are the bank identification number that is unique to each bank.

- Digits 7-15 are the cardholder information.

- The last digit is the check digit to see if the number is correct.

Share This Article